Breaking Free From Low Interest Rate Shackles: Creative Solutions for Homeowners

A few alternatives to selling your home amidst higher rates.

Have you heard anyone talking about the low interest rate golden handcuffs? Essentially, there are a lot of homeowners that would like to move, but they feel trapped by their sub-4 % interest rate that they don't want to give up. It's a big issue affecting our market right now. 90% of mortgage holders have an interest rate below 3.5%, which is about half of what interest rates are now. Therefore, let's talk about three things you can do instead of selling:

1. Become a landlord. You can keep your current home with a low interest rate and then just rent out the property. Then you can buy a new home, and there are a lot of deals to take advantage of in today’s market. Plus, there are a lot of tax incentives involved in being a landlord. Overall, it's an amazing way to build wealth.

“You have options if you don’t want to sell.”

2. Get a home equity line of credit (HELOC). This is essentially a loan against the equity you have in your home. This could help you buy an investment property or even improve the home that you’re in.

3. Build an auxiliary dwelling unit (ADU). This is essentially building a guest house on your property. These can help you build wealth without having to sell your home. Therefore, sometimes this is a better way to go. A lot of older homes already have a way to add an exterior entrance to a couple of rooms. Then you have two doors for the price of one.

As always, if you want to know more about these strategies, don't hesitate to call me. I look forward to talking with you soon!

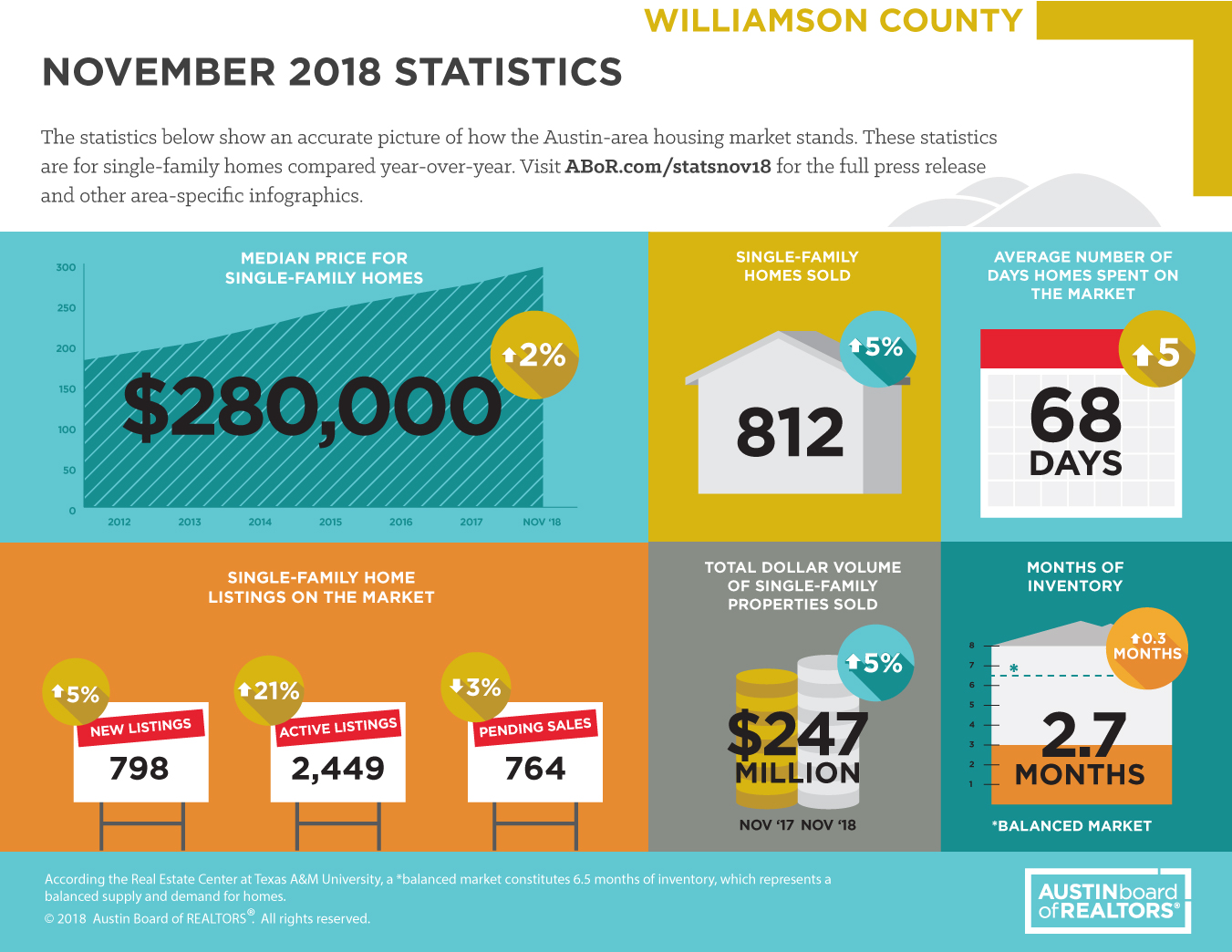

November 2018 Market Report - Austin home prices are up 5.5% Year over Year

The Fall into Winter real estate market is still going strong in Austin. With sales up 5.5% in Austin and median homes prices still on the rise, look to 2019 housing market starting off really strong!

November 2018 Market Report - Austin home prices are up 5.5% Year over Year

We are nearing the end of the year and sales are still seeing positive trends with 2018 shaping up to be another record setting year.

Sales in City of Austin proper are still very strong with the median home price up 5.5% to $374,900 from last November . With 618 homes sold in November (down 5%) and only 1.9 month’s of housing inventory, Austin is still firmly in an Extreme Seller’s Market.

The rest of the Central Texas market is starting to see a slight slow down in sales with 2.7 month’s of housing inventory, up .2 month’s from last year. With slightly more housing inventory and homes taking a little longer to sell (average of 64 days on the market, up 3 days from last year) we may start to see home prices outside the city limits slow down. Right now, prices are still up (median home price is $301,391, up 2% YoY), homes sell are up (2,201 homes sold in November, up 1% YoY) and $839M in sales volume, up 6% Year-over-Year.

In summary,

SELLERS are in all parts of the market are still in a strong position to net top dollar on their home. Buyers have high expectations for what they are buying since it is starting to cost more per month for the same home with interest rates going up from 3.5% to 4.75-5% in just over a year.

BUYERS are starting to see slightly less competition for homes in the suburbs and outlying cities. The best homes are still selling fast and for top dollar, but there are starting to be more “Deals” out there.

INVESTORS are having to be patient while looking for the best deals and act fast when they come up. Income properties are harder to come by. Foreclosures are up slightly. Look to the smaller markets outside of Austin for the best investments.

See below for infographics and analysis of all parts of our Central Texas Real Estate Market.

And as always, please contact us if you or anyone you know needs help buying, selling or investing in real estate in 2019!

Here is the Press Release from the Austin Board of Realtors with the rest of the market update for November 2018.

AUSTIN, TX–As single-family home sales continue to rise, another record-breaking year is expected for the Austin-area housing market, according to the latest monthly report from the Austin Board of REALTORS®. The November 2018 Central Texas Housing Market Report released today suggests another strong showing for the region.

"Sales are up 3.3 percent year-to-date for 2018,” Steve Crorey, president of the Austin Board of REALTORS®, said. “Pending sales volume in December, the Central Texas housing market is on track to have one of the highest-grossing years on record."

Austin-Round Rock Metropolitan Statistical Area (MSA)

In the Austin-Round Rock Metropolitan Statistical Area (MSA), sales volume slightly increased 0.7 percent year over year from 2,185 sales in November 2017 to 2,201 sales last month. Sales dollar volume increased 5.6 percent year over year to $839,317,911, while the median home price increased 2.2 percent year over year to $301,391.

New listings for the five-county MSA increased 1.7 percent year over year to 2,380 listings in November. During the same period, active listings increased 11.5 percent to 6,907 listings and pending sales increased 2.5 percent to 2,217 pending sales. Monthly housing inventory increased by 0.2 months to 2.7 months of inventory.

"Families and young professionals continue to move to the suburbs where there are more opportunities for home ownership at a more reasonable price point than in the city of Austin," Crorey said. "While home sales growth isn't as rapid in the city, demand is still strong. Analysts predict Austin will be a market to watch in 2019."

City of Austin

In the city of Austin, home sales decreased 5.4 percent year over year from 653 sales in November 2017 to 618 sales last month. During the same period, sales dollar volume remained flat at $288,251,771. The median price of single-family homes rose 5 percent to $374,900. New listings decreased 3.9 percent to 697 listings; active listings decreased 2.4 percent to 1,487 listings; and pending sales decreased 4.6 percent to 638 pending sales. Monthly housing inventory decreased by 0.1 months to 1.9 months of inventory.

Travis County

In Travis County, November single-family home sales slightly decreased 0.5 percent year over year to 1,029 home sales, but sales dollar volume increased 5 percent to $474,252,517. The median price for single-family homes rose 5.4 percent to $355,000. During the same period, new listings decreased 0.9 percent to 1,189 listings; active listings increased 2.7 percent to 3,112 listings; and pending sales increased 0.8 percent to 1,058 pending sales. Monthly housing inventory decreased 0.1 months year over year to 2.4 months of inventory.

Williamson County

In November, Williamson County single-family home sales increased 4.5 percent to 812 home sales and sales dollar volume increased 4.9 percent to $246,902,818 since last November. During the same period, the median price for single-family homes increased 1.8 percent to $280,000. New listings increased 4.9 percent to 798 listings; active listings jumped 20.8 percent to 2,449 listings; and pending sales decreased 2.6 percent to 764 pending sales. Housing inventory increased 0.3 months year over year to 2.7 months of inventory.

Hays County

Hays County single-family home sales rose 1.9 percent to 269 sales in November, and sales dollar volume spiked 18.6 percent to $94,305,038. The median price for a single-family home increased 2.8 percent to $262,047. During the same period, new listings increased 7.3 percent to 281 listings; active listings experienced a double-digit increase of 15.9 percent to 950 listings; and pending sales increased 21.1 percent to 287 pending sales. Housing inventory increased 0.3 months to 3.2 months of inventory.

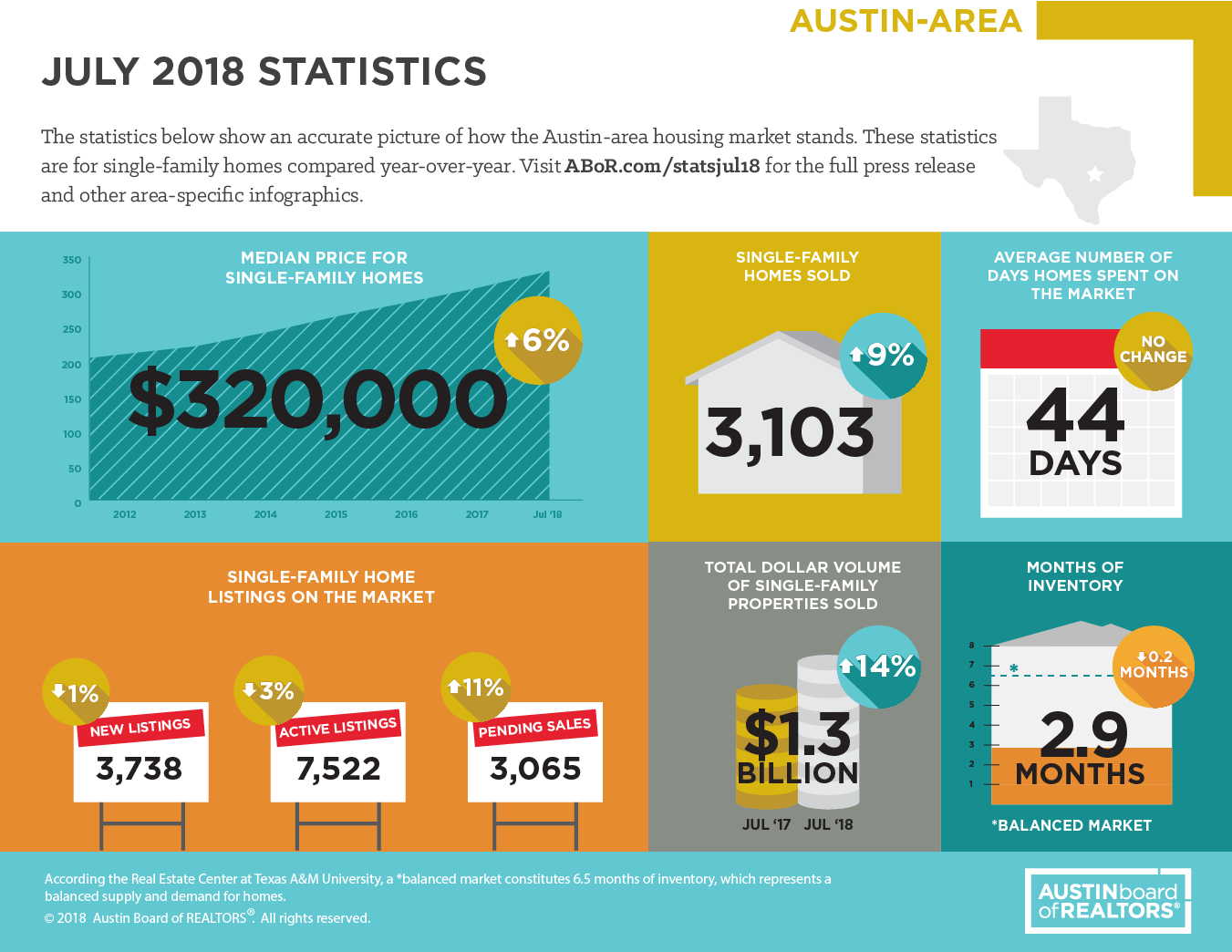

July 2018 Market Report - Single-family home sales experience double-digit growth

Summer is over and the market has started to enter it's cooling off period. School is starting, Football season is right around the corner and Austin is in need of a much needed break from the heat. The same goes for the Hotter than Hot real estate market that reached new highs for the month of July.

July 2018 Market Report - Single-family home sales experience double-digit growth

Summer is over and the market has started to enter it's cooling off period. School is starting, Football season is right around the corner and Austin is in need of a much needed break from the heat. The same goes for the Hotter than Hot real estate market that reached new highs for the month of July.

Here is a quick snapshot of what happened in July 2018:

The Median home price for Central Austin (which includes the entire 5 county MSA) is $320,000, up 6% year over year. The volume of sales has also increased by 9%, up to 3,103 homes sold in July. The average days on market (44) and the total supply of homes (2.9 months of inventory) has stayed somewhat flat. However, with fewer homes coming on the market than last year and more homes selling, our market is continuing to tighten up with demand far exceeding supply.

Here is the Press Release from the Austin Board of Realtors with the rest of the market update for July 2018.

AUSTIN, TX– Strong homebuying activity throughout the summer led to double-digit home sales growth in July, according to the July 2018 Central Texas Housing Market Report released today by the Austin Board of REALTORS®. The five-county Metropolitan Statistical Area (MSA) experienced the highest volume of home sales since July 2011, and the highest median home price on record for any month.

“Strong pending sales activity in June contributed to a big uptick in home sales growth last month, and pending sales growth was strong again in July, too,” Steve Crorey, 2018 president of the Austin Board of REALTORS®, said. “This means we could see another uptick in home sales growth in August to end the summer selling season on a high note.”

In the city of Austin, single-family home sales experienced a double-digit increase of 13.5 percent year over year to 952 sales, while sales dollar volume increased 19.8 percent to $451,315,853 in July.

Austin-Round Rock Metropolitan Statistical Area (MSA)

In the Austin-Round Rock MSA, July single-family home sales increased 8.8 percent year over year to 3,103 sales, while sales dollar volume increased 13.7 percent to $1,254,255,680. The median home price increased six percent year over year to a record-breaking $320,000.

For the second month in a row, pending sales growth experienced strong gains across the MSA, increasing 8.3 percent year over year to 3,201 pending sales in June and 10.8 percent to 3,065 pending sales in July. However, the number of homes on the market fell during the same time frame. In July, active listings for the five-county MSA fell 2.7 percent to 7,522 listings and new listings decreased 1.2 percent to 3,738 listings.

“Housing construction is at an all-time high in Central Texas, but the pace of new housing stock entering the market can’t justify last month’s jump in sales growth on its own. These gains in home sales activity are being driven by pure demand,” Vaike O’Grady, Austin regional director for Metrostudy, said.

“Home sales are up across the board in the Austin area, but declines in housing inventory are almost just as steep. The city of Austin, in particular, lost almost half a month of inventory from July 2017 to July 2018. That's a lot of inventory to lose year over year,” Crorey said. “ABoR housing market data underscores not only the ongoing strong housing demand in our region, but the critical need for more housing stock at all price points in and around Austin.”

City of Austin

In the city of Austin, the July median price for a single-family home increased six percent year over year to $390,000. During the same time frame, new listings decreased seven percent to 1,066 listings; active listings decreased 13.8 percent to 1,675 listings; and pending sales rose 11.6 percent to 904 sales. Monthly housing inventory decreased 0.4 months to 2.1 months, well below the Real Estate Center at Texas A&M University’s benchmark of 6.0 months as a balanced housing market.

Travis County

In Travis County, July single-family home sales increased 15.7 percent year over year to 1,594 home sales, while sales dollar volume increased 17.5 percent to $769,540,765. The median price for single-family homes grew 4.5 percent to $375,000. During the same period, new listings remained relatively flat, with a 0.3 percent increase to 1,854 listings. Active listings decreased 7.8 percent to 3,543 listings, while pending sales jumped 12.3 percent to 1,503 sales. Monthly housing inventory decreased 0.3 months year over year to 2.8 months of inventory.

Williamson County

In Williamson County, July single-family home sales increased 5.7 percent year over year to 1,054 home sales, while sales dollar volume increased 7.7 percent to $326,159,581. During the same period, the median price for single-family homes increased 2.1 percent to $280,734. New listings decreased 6.5 percent to 1,204 listings; active listings decreased 2.1 percent to 2,497 listings; and pending sales rose 10.6 percent to 1,055 pending sales. Housing inventory decreased 0.2 months year over year to 2.8 months of inventory.

Hays County

In July 2018, Hays County single-family home sales rose 2.7 percent to 347 sales, while sales dollar volume slightly decreased, with a 0.6 percent decrease to $113,218,199. Median price decreased three percent year over year to $265,000. During the same time frame, new listings remained relatively flat, with a 0.2 percent increase to 478 listings; active listings increased 5.9 percent to 1,045 listings; and pending sales rose 6.1 percent to 366 sales. Housing inventory increased 0.1 months to 3.6 months of inventory.

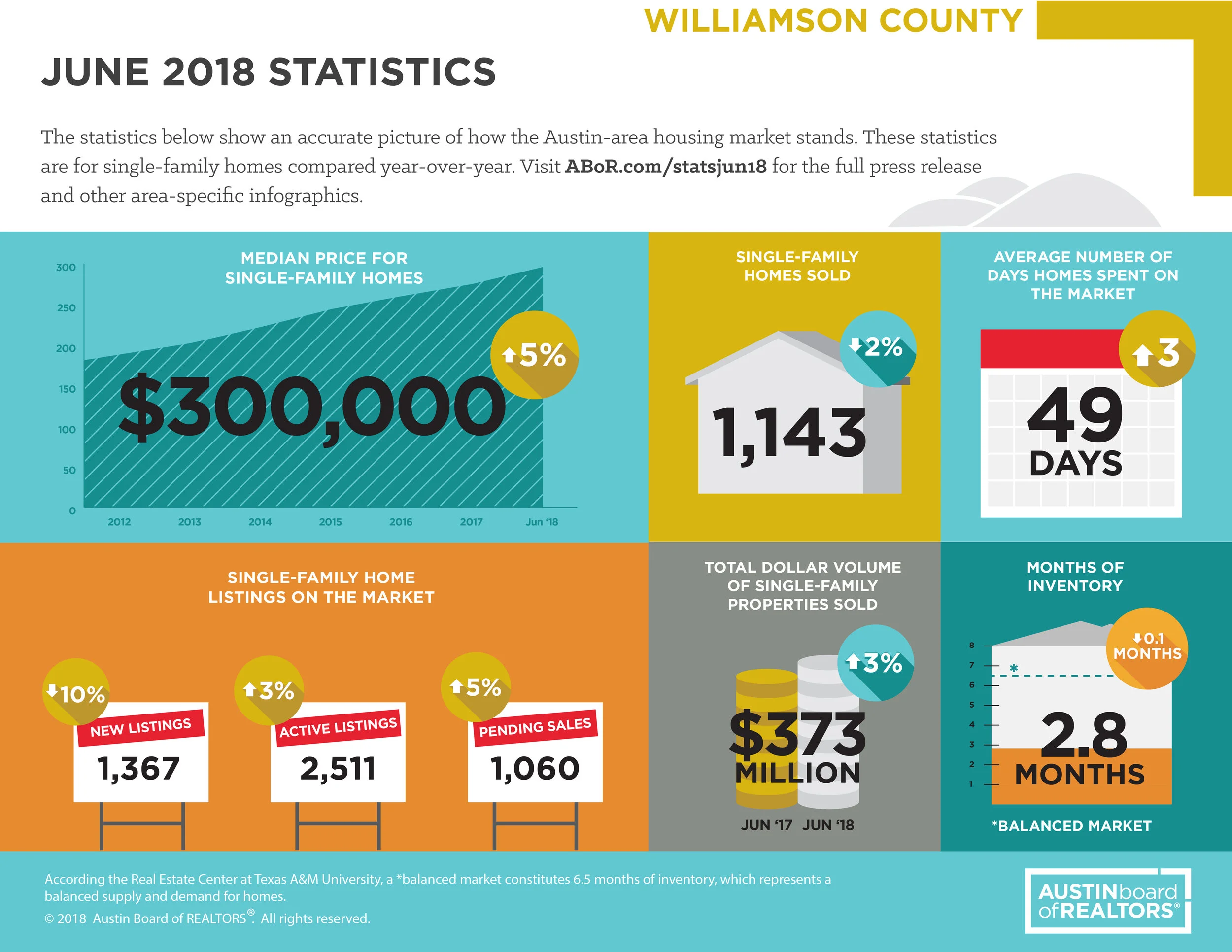

2018 Austin Mid Year Market Update

Specifically, the real estate market has been experiencing some new highs and just a few indicators that the real estate market has been shifting. I decided to take a new approach to interpreting the data. I am including the Austin Board of Realtors entire Press Release here. I will be adding my thoughts and commentary in BOLD Italic…

Welcome to the second half of 2018!

The Austin real estate market has been experiencing some new highs and just a few indicators of a possible shift. We have decided to take a new approach to interpreting the data. We are including the Austin Board of Realtors entire Press Release here. I will be adding my thoughts and commentary in BOLD Italic.

---

Austin Board of REALTORS® releases June & Midyear 2018 Central Texas Housing Market Report

AUSTIN, TX– Single-family home sales in the Austin-Round Rock Metropolitan Statistical Area (MSA) experienced strong and steady growth in the first half of this year but declined in June 2018, according to the June & Midyear 2018 Central Texas Housing Market Report released today by the Austin Board of REALTORS®. In the first half of the year, area home prices continued to increase and housing inventory levels slowly declined amidst strong housing demand.

“Despite a decline in home sales volume across Central Texas in June, 2018 is on track to be another record-setting year for the region’s housing market,” Steve Crorey, 2018 president of the Austin Board of REALTORS®, said. “Consecutive years of record-breaking sales activity have set the bar incredibly high, and it’s important to remember that we’re comparing June 2018 figures to that strong activity. The Central Texas housing market remains strong and continues to move at a demanding pace.”

The slow down in sales is purely Supply-driven. Fewer people are putting their homes on the market, so there are fewer sales. Buyer demand remains at a record high.

Austin-Round Rock Metropolitan Statistical Area (MSA)

In the five-county MSA, single-family home sales increased 3.7 percent year-over-year to 15,364 home sales, while the median home price increased 4.3 percent year-over-year to $313,000. The volume of homes on the market declined year-to-date, although pending sales activity increased during the same time frame. From January to June 2018, active listings fell 0.8 percent to 5,951 listings; new listings decreased 0.6 percent to 21,795 listings; and pending sales rose 4.8 percent to 17,008 sales. Sales dollar volume in the Austin-Round Rock MSA was $6,025,035,605—an 8.2 percent increase from the first six months of 2017.

In June 2018, single-family home sales activity declined 2.7 percent year-over-year to 3,299 sales. During the same period, the median price for a single-family home rose 4.9 percent year-over-year to $326,250. Monthly housing inventory decreased 0.1 months year-over-year to 2.9 months, well below the Real Estate Center of Texas A&M University’s benchmark of 6.0 months as a balanced housing market. While home sales decreased across the MSA in June, this is not indicative of a declining housing market, suggested Jim Gaines, chief economist at the Real Estate Center at Texas A&M University.

“The Central Texas housing market is among the top three in the country. The region’s population growth, particularly along the I-35 corridor, is fueled by diversified economic opportunities that bring jobs, new businesses, and resources across multiple industries,” he said. “Strong population growth and home sales activity are expected to continue in the Central Texas region for the rest of the year and into 2019.”

Our overall market is still experiencing contracted inventory and increased demand. Buyers are either paying more for homes or buying new construction homes further outside of the city.

City of Austin

In the city of Austin, single-family home sales in the first half of the year edged upward 1.3 percent year-over-year to 4,757 sales and the median price for a single-family home increased 3 percent to $375,760. During the same period, active listings decreased 10.1 percent to 1,279 listings; new listings decreased 3.9 percent to 6,458 listings; and pending sales rose 2.7 percent to 5,248 sales.

City of Austin home sales have not experienced a year-over-year decrease in the month of June since 2013. Austin home sales decreased 4.5 percent to 988 home sales and median price dipped 0.4 percent to $388,000. Housing inventory also decreased 0.3 months to 2.1 months of inventory. However, homes spent six fewer days on the market in 2018 than the previous June, averaging 30 days on the market.

We are seeing a slight housing price correction in the City of Austin. Appraisers and banks are being more conservative to stave off a bubble. Median prices also could be going down slightly because there is even more activity below that price where there is more affordability as prices continue to rise.

Travis County

In Travis County, single-family home sales increased 3.8 percent year-over-year to 7,675 home sales in the first half of the year. During the same time frame, the median price for single-family homes grew 3.6 percent to $362,500. Active listings decreased 6.1 percent to 2,796 listings; new listings decreased 1.2 percent to 10,977 listings; and pending sales increased 6 percent to 8,587 sales.

In June 2018, single-family home sales decreased 2 percent to 1,651 home sales, while median price increased 1.2 percent to $374,500. Monthly housing inventory decreased 0.2 months to 2.8 months of inventory.

Williamson County

In Williamson County, single-family home sales in the first half of 2018 increased 5.2 percent year-over-year to 5,333 home sales. During the same period, the median price for single-family homes increased 3.7 percent to $286,900. Active listings increased 5.2 percent to 2,033 listings; new listings decreased 0.8 percent to 7,303 listings; and pending sales rose 4.7 percent to 5,832 sales.

In June 2018, single-family homes sales dipped 1.7 percent year-over-year to 1,143 sales, while the median price rose 4.7 percent to $300,000. During the same time frame, housing inventory declined 0.1 months to 2.8 months of inventory.

Hays County

In the first half of 2018, Hays County single-family home sales rose 2.6 percent year-over-year to 1,721 home sales, while median price increased 3.3 percent year-over-year to $264,900. New listings increased 2.2 percent to 2,536 listings and active listings increased 1.9 percent year-over-year to 799 listings. During the same time frame, pending sales rose 4.4 percent to 1,907 sales.

In June 2018, single-family home sales decreased 7.1 percent year-over-year to 369 sales, while median price increased 7.5 percent year-over-year to $284,900. During the same time frame, housing inventory increased 0.1 months to 3.4 months of inventory.

With new listings increasing in Hays and Williamson County, more people are willing to sell and move up or move closer in with the higher values of their homes. This trend will continue with affordability continuing to be an issue within Austin City Limits.

To find out what your home is worth in today's market or ask any related housing question, please don't hesitate to reach out to us at BIRDHOME---home@birdhome.com or call (512) 596-2035.

Using Real Estate To Build That College Fund

SAVING FOR COLLEGE WITH REAL ESTATE

Two months ago, my wife and I welcomed twin boys into the world. In the next few months, we’ll have their entire college education effectively paid for using proportionally very little of our own money. How? Through long term real estate investing.

Our goal is a lofty one: be able to pay for 100% of our children’s total college expenses. This amounts to roughly $215,000 per child for four years at a public, in-state school by 2037, when the twins will begin their final year of college. So, we’re anticipating needing roughly $430,000. That’s in addition to meeting our own retirement, investing, giving, and lifestyle goals. Daunting!

However, we have a plan—and a rather simple one at that:

Buy a single family home and rent it out.

Let our tenants pay down the mortgage over the next 18 years.

Sell or refinance the property.

Use the proceeds to pay for our twins’ college expenses (or whatever else).

But there’s much more to it.

First, we have to define the right property. How much house should we buy? The initial constraint is that we need to net at least $430,000 from the sale or refinance of the property by the time college rolls around. We know we’re unlikely to hit this number exactly, and coming in too low would be much worse than ending up better than we planned. So, we’re choosing to err by overshooting our target.

Suppose that the property we buy will appreciate on average 5% each year for the next 18 years—a figure I believe to be slightly on the conservative side for central Texas, the Austin area especially. With 20% down and 4.625% fixed for 30 years—typical for non-owner occupied mortgages from retail lenders—we’re looking for a home worth around $240,000.

With $468,656 in projected equity after 18 years using conservative mortgage terms, we will have room to choose between selling the property and refinancing when 18 years is up. Either way, we should come out at or above the $430,000 target. Note, also, that the numbers above do not take into account reinvesting future rental cash flow into improving the property making additional mortgage payments. Once we take that into account, things look even better.

Beyond the numbers, we want at least a 3/2 home in a good school district and strongly prefer a single-story with at least three-sides masonry. We’re also not particularly concerned with the investment generating meaningful cash flow in the near term. In fact, we’d be happy if we can come close to breaking even over the next few years. We don’t expect rental rates to fall on single family in the Austin area over the next 18 years. In fact, we expect meaningful cash flow over the longer term as rental rates continue to rise. This will help us accelerate mortgage pay down and build equity faster.

Second, there’s the matter of actually finding the property. Our time horizon is long on this particular investment. So, we’re not against purchasing a rental-ready home straight off of the MLS. However, who’s not up for a deal? In a future blog post, I will detail some strategies I (and other investors) use to source deals in this hot central Texas seller’s market. However, in the Austin area market, for the type of property we’re looking for (described above), we’re most likely going to have to buy it retail on the MLS or from builder inventory.

Third, we need to determine the best way to buy the property. In one way or another, we’ll need to get a mortgage. Mortgage loans can come from many sources: private individuals, banks, mortgage brokers, mortgage bankers, credit unions, etc. It makes sense to shop around heavily. However, for a 30-year non-owner occupied fixed rate mortgage from a retail lender, we’re looking at around 4.625%. Mortgage insurance doesn’t cover investment properties. So, we’ll need to put at least 20% down, which comes out $48,000.

I realize that $48,000 is a significant amount to most of us. Indeed, the down payment will most likely be the largest hurdle for most of you reading this. In a future post, I’ll outline sources of long term investment property financing that can require less than the usual 20-25% down for well-qualified borrowers. It’s also possible to tap equity in your primary residence via a HELOC to make a down payment. However, realize that, if you’re going to be saving for your child’s college anyway, you can put off the strategy I’m describing here in order to raise the funds needed for a down payment. Just be sure the money you’re putting aside is invested in a vehicle that will keep pace with inflation and provide some growth, such as a short-term bond mutual fund.

The upside is that, once we commit that down payment, we’re effectively done paying for our kids’ college. For the next 18 years, we’ll have other people (our tenants) paying toward our kids’ future education while the property appreciates in value.

Fourth, we’ll have to get the property leased and managed. For those with less experience or time, but especially if it’s the first time, it almost always pays to work with a REALTOR®. He or she will help prepare, price, and market the property, ensure compliance with the relevant local, state, and federal regulations, provide leasing and other paperwork, screen potential tenants, and negotiate on your behalf. For these services, a REALTOR® typically requests compensation equal to one month’s rent. Fortunately, as an experienced REALTOR® and investor, I’m comfortable with all that goes into getting a property leased to a great tenant for top market rent in central Texas.

What about management? It is perfectly possible to manage one or a few single-family rental properties while maintaining a full-time job, as long as you have the temperament for it and the properties are within your immediate area. In fact, unless a property is a significant distance away, I don’t see any reason to have a single-family investment property professionally managed, unless you really are just too busy, uncomfortable being a landlord, or simply have too many properties to manage alone. Though nobody enjoys getting a call about a leaking water heater or a broken A/C in the middle of dinner, my wife and I enjoy even less someone else taking a cut of our rental income.

Finally, I’d like briefly to mention one unique benefit to this method of saving and paying for a child’s education on which it’s difficult to place a dollar value. As soon as my twins are old enough, which is sooner than you’d think, they will help me run every aspect of the property. I want them to really feel like it is their house, their tenant, their investment, and ultimately, their responsibility. They will need to learn to make and follow through with plans, interact with others, and work together to solve problems. This will provide me years of opportunities to teach financial and personal lessons and bond with my sons.

Though there are plenty of great ways to save for a child’s college (e.g., a 529 Savings Plan), my wife and I believe the real estate based strategy outlined above makes good financial sense. However, we are aware of the risks involved when compared to other options. I could give a list of pros and cons, but my goal here has been to describe what my wife and I plan to do, not argue that everyone should follow in our footsteps. However, I do think it’s something anyone facing the uphill battle to save for a child’s college expenses should consider seriously.

If you’d like to discuss real estate as a way to save for college (or even retirement), reach out to me below or give me a call at (512) 991-4801x3.

RELEVANT RESOURCES:

At BIRDHOME, we strive to help our clients, friends + family build generational wealth through real estate investing. At the BIRDHOME blog, we're sharing our expertise in the Austin real estate market to help guide you to your new home.

let's connect

Contact us directly at home@birdhome.com

or call us anytime at 512.585.1571