The Biggest Mistake We Made When Listing Our Own Home

What a wild ride this has been! If you missed our last blog post, we are walking the walk of the talk we talk and purchasing an investment property that we will move into, fix up and pay off in 3 years. Just as a reminder, here is the timeline of our "Building Wealth Through Real Estate" adventure:

Tuesday, March 7th - We made an offer to the seller.

Sunday, March 12th - We executed the contract for the purchase of the house.

Thursday, March 16th - We attend the inspection and I saw the house for the first time.

Tuesday, March 21st - Pictures and Videography are taken for our current home, getting ready to go on the market.

Wednesday, March 22nd - We go live in the MLS and plan to host an Open House on Thursday evening, Saturday and Sunday afternoons.

Friday, March 24th - A buyer made us an offer we couldn't refuse and we signed off! Under contract!

One of my big ahas from the Keller Williams conference we attended in February was "If you want to impress people, talk about your accomplishments. If you want to influence people, talk about your mistakes." - Matt Townsend, The Art of Adding Value

So, let's talk about the biggest mistake we made when we decided to sell our house: WE DIDN'T HIRE A REALTOR TO HELP US!

What do you mean? This is what you do and you're consistently ranked in the top 5% of real estate professionals in Austin.

True, but there is so much more to it than just the process, marketing, communication, paperwork, prep, staging, negotiation, etc. - selling a house is emotional.

Home is the second most emotional word in the english language. Can you guess what the first is? (Click here to send me your guess and the first 5 to answer correctly get a prize!) Buyers buy homes, sellers sell houses, so from the very beginning when we sit down with a client to discuss selling, we begin the transition from home to house through our language.

I have always said that our #1 job is to manage emotions despite expectation and have such an incredible appreciation for what we do as real estate professionals, because you can't put a price on helping with the emotional side of a transaction. As a Realtor, we absorb all of the emotion in a transaction on behalf of our client so that they can focus on their daily life and making plans for their upcoming move.

If you notice in the video tour of our house above, I mentioned "home" and "favorite" and "love" more times than I care to count. Naturally, we take pride in the place where we live, laugh, love, entertain and create memories. There is an art to packaging and marketing a house as a commodity in order to get the highest value for the seller.

Moving forward, our goal is to never sell another home, but if we do you can bet that we will be interviewing real estate agents to list our house. Read our blog post on the "Top Ten Interview Questions You Should Ask a Real Estate Agent" for guidance on what to ask when you are interviewing an agent.

As I mentioned in my previous post, we would like to share our resources that have helped us on this journey - The Total Money Makeover by Dave Ramsey & The Millionaire Real Estate Investor by Gary Keller.

P.S. I think I found my first gray hair

Our Personal Journey to Building Wealth Through Real Estate Investing

When Patrick and I got married our net worth was negative over a hundred thousand dollars. Student loan debt, credit cards, unpaid taxes and million tiny poor decisions contributed to that. Fast forward to now, and we have powered our way almost back to zero debt, a positive number in our net worth with 2 fully paid off cars, 2 investment properties and a beautiful home.

Now it's time to walk the walk of the talk we talk. When we got married, we made a promise to each other that we would never have a car payment. Sure enough, shortly after we got married, we needed a new car. So, what did we do? We literally bought a grandma car. It was our friend’s grandmother’s 2001 Cadillac Catera that she had been given upon graduation from law school. We paid her and her huband $3000 cash for the car (her husband requested that to be in $100s so he could "make it rain") and Patrick drove it for 18 months.

Fast forward to today. We started our own business a little over a year ago and have a beautiful, amazing daughter. Things sure do change when you have kids, right? We have decided to embark on our next family promise - never having a mortgage payment ever again. What the what?!?

Total financial freedom can mean many things to many different people. For us, it means to never have to make a business decision based on our personal finances. It means unlimited opportunities for the future and leverage.

When your why is big enough, the how will come. Ok, so how? We are going to start by selling our house. We have had the amazing opportunity to purchase another investment property way under market value and have set a goal to pay it off in 3 years. 36 months. We will take the proceeds from the sale and use part to pay off our last remaining debt, part for the down payment and a small amount for paint, flooring and a few small updates.

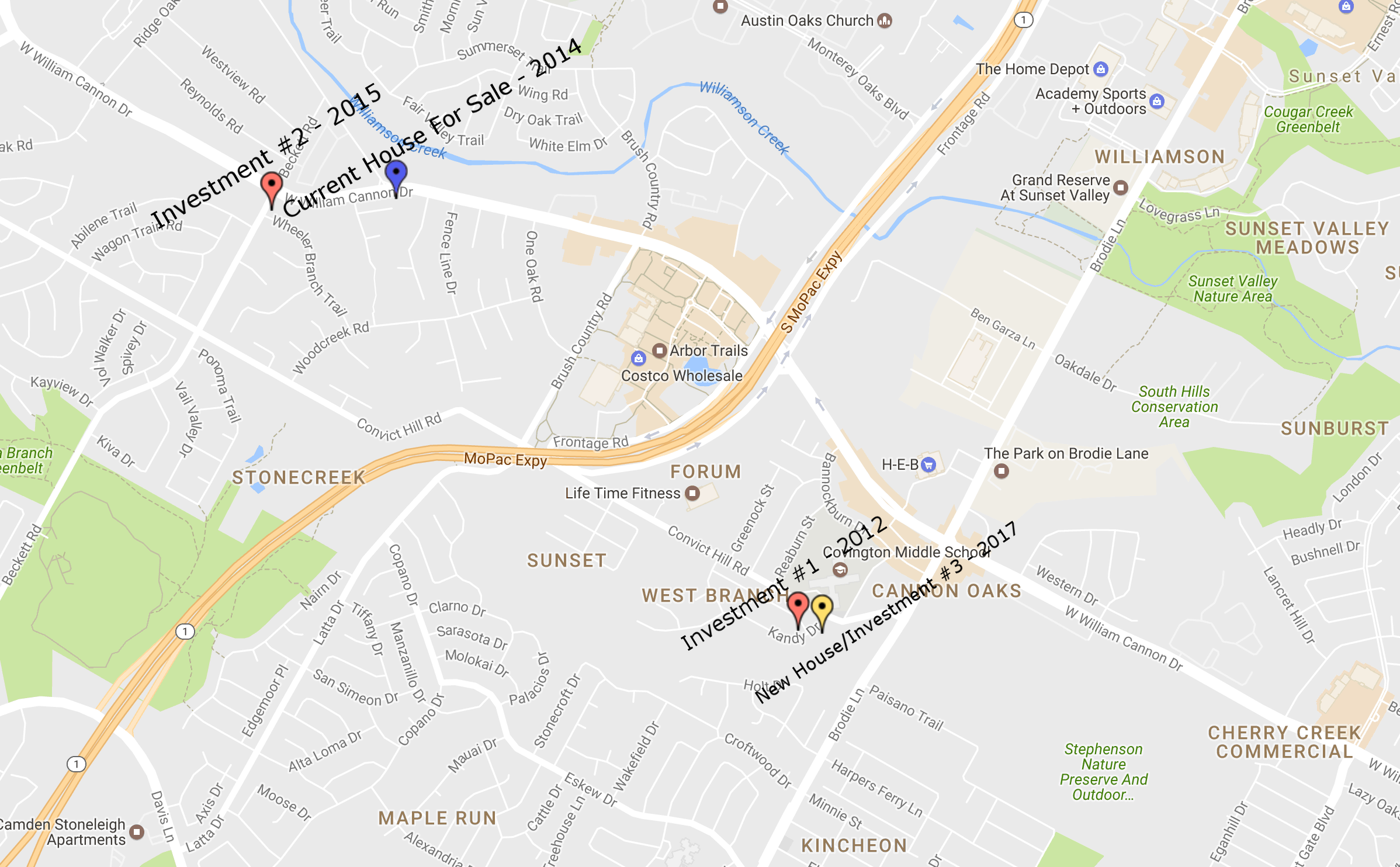

The first home we purchased was in 2012 for $160,000 (current market value today is $275,00). We kept that home as a rental and moved to our current home at the end of 2014 which we paid $340,000 and will be putting on the marker for $429,000. In 2015, we had the opportunity to purchase another investment property in our neighborhood for $300,000 (current market value today is $400,000). We did a 1031 exchange with an investment property we owned up north for that purchase. It was one of those "right place at the right time" while walking the dog late one night. As you can see, all of these properties are within less than 2 miles.

At this point we owned 3 properties, but our 2 investment properties are just breaking even. We're in it for the long term, but we started flirting with an uneasy feeling of not having enough saved when inevitably something would go wrong. Let's not also forget that we took the leap to start our own real estate company at the end of 2015.

Our original plan was to move back into our first investment property - the one we moved from in 2014. We owed the least on that house, so it would be the easiest to pay off. One catch, we have a unicorn of a tenant. For anyone who owns investment properties, you know that it's worth doing whatever it takes to keep them.

Since forming and maintaining relationships in our old neighborhood, we have had a "coming soon listing" across the street on Kandy for 4 months. The seller has been trying to get the house ready to go on the market in that time. So, last Tuesday (3/7) I called Patrick and said "Let's make him an offer". It's a win-win. He doesn't have the hassle of going on the market and we get to have another future investment property. He said "Are you sure? Don't you want to see it?" to which I replied "No, it will distract from the goal." So we signed the paper work on Sunday (3/12) and then did our inspection and my first walk through on Thursday (3/16). I will be sharing full financial details once we are closed.

Here is a peek inside the house:

We are so excited to share this journey to debt freedom. Our hope is to set an example of making a sacrifice in the short term for long term future gains. Want to know more? We are so excited to share our message that we want to send you a free gift of the resources we used on this journey - The Total Money Makeover by Dave Ramsey & The Millionaire Real Estate Investor by Gary Keller.

PS: We're going to paint the front door pink!

Austin Real Estate in 2017: Predictions, Educated Guesses and Random Fun Facts

Everyone wants to know what will happen with our amazing real estate market in 2017.

Many are asking about the slowdown in growth and fewer job openings reported in recent months. In all honesty, is it really feasible for one city continue to grow by 4% per year?

Others have asked about the National trends happening right now. With a change in direction in Washington and a slowdown in some real estate markets around the country, can Austin real estate continue going up in value?

Finally, there are some in Austin that are just ready for a breather. They are ready for our market to take a break and at least feel like they can afford to live here again. I understand this sentiment more than any of the others. One, because we have started to feel the economic pinch. And two, because the pace at which we have to work to keep up with the real estate market is intense.

Supply and Demand

There is only one factor that I have learned to pay attention to in real estate and it is very simple. Supply and Demand dictate what will happen more than any other economic indicator.

When the supply of homes is down… prices will go up.

When the supply of homes is up… prices will soften or go down.

Other factors can manipulate the market in some ways. Interest rates have started to go up slightly. A year ago they were around 3.5% for a 30 year fixed rate loan. Now that same loan is between 4-4.5%.

Schools, walkability, area amenities can drive local niches to be more in demand than others. For example, in Austin the St. Elmo Public market with condos, shopping, hotel, restaurants and office space is set to change the 78745 zip code in a big way. Home prices have been going up steadily in the area in line with the rest of the housing market. Look for a large spike to happen in the next few years as the area becomes more desirable for millennials and boomers alike.

The nitty gritty of our real estate market

As an overall market, the Central Texas 5 county MSA has about 6,300 homes actively for sale on the market. In the last 3 months, about 2300 homes have been selling per month. This is a 2.74 month’s supply of homes. Meaning, if we sold every home on the market and no new homes came on the market, it would take a little less than 3 months to run out of inventory.

As a quick guide, a seller’s market has 3 months or less of housing inventory, a balanced real estate market has around 4 to 6 months supply of homes and a buyer’s market has 7 months or more of inventory.

What is interesting about these numbers and somewhat deceiving is what this “inventory of homes” actually consists of.

Here are a few fun facts to noodle over:

Only 36% of this inventory is in the city limits of Austin. Of which, the average asking price is $750,000 and the median asking price is $460,000.

12.7% of the housing inventory are condos or townhomes. Condos are a little more affordable with an average asking price of $321,000 and median asking price of $258,000

An astonishing 38% of this inventory is new construction. ⅔ of which is not being built in Austin. As per my usual spiel… new homes are selling for a premium over resale homes.

Here is a little more interesting fact:

18.5% of the current housing inventory actively for sale on the market is price below the median price sales of $290,000. Median, meaning in the middle, would indicate that either 31.5% of the current active housing is over-priced. And/Or, a large portion of the properties above the median sales price are not going to sell at all.

Lets look at something a little more indicative of where the market is heading:

11.2% of the the housing inventory has been on the market for less than 2 weeks.

26.5% of the housing inventory has been sitting on the market longer than 2 months… which is when I start to see houses get stale on the market. I.e. Fewer showings, less interest, etc.

This is all relative, because the average days on market is currently sitting at 55 days, while the median days on market is 29.

Do you think Price doesn’t matter?

The average asking price of homes that HAVE NOT SOLD is $629,000. The median asking price of homes that HAVE NOT SOLD is $400,000.

The average asking price of homes that have sold is $382,000 and average sales price is $370,000. The median asking price is $300,000 with a median sales price of $292,000.

Again, these numbers are all relative… I’m not saying that the homes not selling are wildly out of line with the market. I am saying that the asking price matters more than a lot of sellers want to admit.

Lastly, I wanted to include a price band breakdown of what the market currently looks like. This is very much in line with the last several years of Austin’s growth… prime for our market to continue to go up, especially for homes under a million dollars.

It’s amazing how so many people want to hear that the real estate market is slowing down in Austin. The typical assailant to our market is the disgruntled buyer. This is a very short term thought process. Yes, affordability is a very real problem here. However, if you want the market to slow down for personal reasons, it will also be a short term payoff. If the market continues to grow and expand and---appreciate, it would be in everyone’s best interest for the market to continue going up in value.

Yes, there are pockets of our market that are experiencing a bubble and/or have a high supply of homes. Mainly, the upper end of the market has begun to experience a slow down and I still tend to think East Austin is experiencing a bit of a bubble.

For example, on the upper end. There is currently an inventory of 8.2 months supply of homes. Compared to market average of 2.3 months supply of homes, this represents a more balanced market headed towards a buyer’s market.

East Austin still has inventory that favors the seller--2.76 months of housing supply and prices are climbing to new highs every month. I don’t see this slowing anytime soon, I just see it being the first area in Austin to experience a major pricing correction if the overall market slows down.

Nationally… the finance guys on Wall Street are feeling bullish. When they feel confident that the economy will continue to expand, so should you.

If we look at Austin, outside the context of the national economy we are still experienceing record low housing inventory… it has certainly increased at the top of the market with over 13 months supply of homes over $1.5M and up.

Resources:

Austin Doubling

http://www.bizjournals.com/austin/news/2016/10/11/get-ready-for-new-neighbors-austin-to-nearly.html

Inman predictions

http://www.inman.com/2017/01/04/the-ultimate-guide-to-what-2017-has-in-store-for-real-estate/?utm_source=weeklyheadlines&utm_medium=email&utm_campaign=sundaysend&utm_content=20170106_hero

http://www.inman.com/2016/12/06/8-experts-predict-the-2017-housing-market/?utm_source=weeklyheadlines&utm_medium=email&utm_campaign=sundaysend&utm_content=20161208_hero

http://www.inman.com/2016/12/14/10-things-real-estate-agents-know-feds-rate-hike/?utm_source=weeklyheadlines&utm_medium=email&utm_campaign=saturdaysend&utm_content=20161216_imagelink

http://www.inman.com/2016/12/13/brad-inmans-crystal-ball-real-estate-predictions-for-2017/?utm_source=weeklyheadlines&utm_medium=email&utm_campaign=saturdaysend&utm_content=20161216_imagelink

http://www.inman.com/2016/12/13/will-2017-be-a-buyers-market-or-a-sellers-market/?utm_source=weeklyheadlines&utm_medium=email&utm_campaign=sundaysend&utm_content=20161216_hero

Can Austin Weather a National Downturn from September

http://www.mystatesman.com/business/could-austin-housing-market-weather-national-downturn/JmFwCWliE7Af4yOvPz6xUO/

Here is why this housing market boom is different

https://blog.abglobal.com/en/2016/09/can-we-afford-a-housing-boom.htm

Redfin predicts…

http://www.businesswire.com/news/home/20161213005834/en/Redfin-Predicts-2017-Fastest-Housing-Market-Record

Trump and housing

https://www.thestreet.com/video/13919680/here-s-what-donald-trump-can-do-to-help-the-housing-market.html?cm_ven=APPLENEWS&puc=applenews

Blackstone

http://www.cbsnews.com/news/blackstones-plan-to-cash-in-on-a-10-billion-housing-bet/?ftag=CNM-00-10aac3a

Fortune… one big trend

http://fortune.com/2016/11/27/real-estate-trends-2017/

Sell Your Austin Investment Property and Get TOP DOLLAR

So you’ve decided to sell your Austin investment property. There are a number of reasons you might be considering this… you’re tired of dealing with tenants, you are moving the money into other investments, it’s time to retire, it’s time to pay for your kids college or you think the market will bust soon and you want to sell at the top. (Call me if you think the last one is true… I would love to hear your reasoning). Either way, it’s time to sell. Here is my list of the top 5 things to do to ensure you sell for top dollar.

Get the tenants out of the property.

Out of all the advice I have, this is the most important to ensure you get top dollar. TENANTS ARE DEAL KILLERS. Their motivations are typically not in line with yours, they have ugly stuff, they don’t clean up and they make the property hard to show. In short, THEY WILL COST YOU MONEY.

Let’s do the math.

The average rent a tenant is paying in Austin is $1,849/month over the last 90 days.

Getting a tenant out and making the house market ready will net you another 1-3% more than if they were in the property. If the average homes sells for $357,859 in Austin, that is potentially another $3,500-$10,500 you are leaving on the table. Between the median days on market at 29 and the average days on market at 55, you’re talking about one or two months rent that you would possibly be missing out on.

You have to put yourself in the buyers shoes… tenants legally have a right to request 24 hours notice for all showings. This right there makes it really hard to show the home. More than likely they won’t be cleaning up, sometimes tenants don’t even leave the property. As a Realtor, try getting professional photos of the home with tenants present. It’s next to impossible.

Now I know this isn’t always the case. I have had some really great tenants who keep the house nicer than I keep my own. If properly motivated---guaranteeing they can keep their deposit, even paying them to work with us on showings, can create a win-win situation. I just wouldn’t count on it and I don’t think you should either.

Get the Property Market Ready

Depending on your budget, you need to be prepared to spend some money getting the property ready for the market. Depending on how long your property has been a rental and how proactive you have been maintaining it will determine your budget.

The first rule is, your tenant’s deposit is only for damage caused by your tenant. Don’t use their deposit as your updating budget. Getting carpets cleaned, air filters changed out, etc are perfectly fine. Replacing the carpet with hardwood floors on their dime is something you could potentially get in trouble for.

Now that we’ve got that out of the way, let’s do a quick run down.

You have a $1k budget:

Do a deep clean of the property--carpets, baseboards, windows.

Have a handyman come in and make minor repairs and paint touch ups.

Get the yard under control and do some light landscaping.

Tune-up HVAC and any other appliances that may need attention.

If you can spend $2500-5000:

Paint the house--possibly inside and out

Consider replacing flooring. If you have to choose which rooms, always start with the living rooms, before moving on to the master bedrooms and then the other bedrooms, baths, etc.

Big Budget of $10,000 to $25,000:

This is where I would consult a professional. If the home is really outdated and/or needs a lot of work, it might make sense to do a more major renovation. I really like the National Association of Realtors Cost vs. Value Report here as a guide for best ROI projects.

However, my list would be the following:

Scrape ceilings and get that popcorn texture out of the home.

Curb appeal is huge. Make sure the front of the home pops.

Get the kitchen updated. On this budget, doing the countertops, backsplash, sink and new fixtures is best. You can always paint the cabinets and put on new hardware to freshen it up.

Faux wood tile is a huge hit right now for flooring. It’s easier and cheaper to install than real wood. Another alternative I would consider is a high-end laminate. They make them now that are very durable and don’t make that strange popping noise when you walk on them.

Updating light and plumbing fixtures is inexpensive and goes a long way. I would also consider changing out all the electric outlets for an easy refresh.

My last item is windows. If you can stretch it, new windows means you care about who is buying the home. They are aesthetically pleasing and will save the buyer money on their electric bill.

Additional resource: Tips and tricks for finding a good contractor

Price it to Sell

I know that everyone wants top dollar right now. It is a seller’s market and the entire reason you might be considering selling is to take advantage of that. The biggest mistake you can make with selling is over-pricing the home.

It is logical to think that if you price it too high to start and no one is willing to pay what you are asking, a simple price adjustment will do the trick. Sometimes it does. However, if you sit on the market too long and right now, I think 6 weeks is too long, the property will develop a stigma. Instead of buyers coming in and being excited about the home, they are looking for reasons not to buy it.

On the flip side, I would not be worried if you didn’t get an offer the first week or two on the market. I’ve had properties sit on the market for a few weeks and then get multiple offers. Sometimes it is good to price it slightly higher and be patient.

This all feeds into my last point at the end of this article regarding hiring a pro. The right agent knows that real estate is hyper-local and every neighborhood has different market tendencies. Make sure the agent you hire to market your home understands the area your home is in. More on this later...

Staging/Styling the House

Buying a home is an emotional experience. You want a buyer to connect with the property, feel like they can live there, start a family there and so on. We firmly believe that staging a vacant home can increase the selling price by an additional 1-3%. Above you will see a home that was on the market for months and didn't sell (top row of pictures). Below is the exact same house that was staged by BIRDHOME and sold the first weekend on the market.

The average buyer CANNOT imagine themselves living in a home. You have to curate that experience for them. Staging does come with an expense and you can decide to do some very light “vignette” staging or you can stage the entire house. I really prefer homes that have the living room, dining room and master bedroom staged. The other bedrooms can sometimes be small to start and can feel smaller with furniture in them.

Additionally, when you have the home staged, it makes the professional photography so much better. It gives the photographer a point of view and helps guide the buyer through the home visually online. And since 99% of buyers start their home search online and decide whether or not to even look at a home in person based on their perception of the home online, this is crucial.

Need help staging? Click here. We offer complimentary staging to our sellers and help other Realtors stage on a case-by-case basis.

Hire a Professional REALTOR

I am going to keep this last point short and simple. I am a firm believer in hiring professionals and paying them well for their services. Anytime I have ever gone for the lowest bid or cheapest alternative, I have paid for it dearly. I know this may come across as self serving, but I can’t help it if it is true.

That being said, here is our guide to interviewing real estate agents. If there is another thing that I stand by, it is interviewing more than one agent for the job. Most people think that all Realtors are created equal. I challenge you to interview more than one to three agents and you will be surprised at the varying levels of professionalism and services they offer.

I still stand by my first point that getting the tenants out will net you the most amount of money when going to sell. Hiring a professional real estate agent to help you navigate preparing the home for the market, determining an asking price for the home, properly marketing your property and negotiating top dollar is a very close second on that list.

Call us, text us or connect with us on social media to get your home sold today.

Additional resources:

Wondering if it is time to sell your investment property? Here is an in-depth analysis.

Interviewing real estate agents? Here is what to ask.

Staging/styling help: Click here

Need help fixing up the house? Tips and tricks for finding a good contractor

IN CONCLUSION:

Get the tenants out of the property.

Make the property “market ready”.

Price it right.

Stage/style the home.

Hire a pro.

It’s time to file your Homestead Exemption

Happy New Year and welcome to 2017!!

Thank you for being a part of BIRDHOME in 2016 and buying a home with us. We want you to start off 2017 on the right real estate foot by filing your homestead exemption form so you can SAVE MONEY on your tax bill at the end of the year.

Depending on the price of your home, filing this exemption can potentially save you thousands of dollars per year.

Who should apply?

You! If you bought a home in 2016 and it is your primary residence, the time to apply and save is now. The deadline to apply is anytime between January 1st and April 30th.

How to Apply for a Homestead Exemption

Below are a list of counties where we sell real estate. Depending on where you live, you will download and file differently.

Travis County Appraisal District

Mailing Address: P.O. BOX 149012, Austin, TX 78714-9012

Williamson County Appraisal District allows for Online filing

Mailing Address: 625 FM 1460, Georgetown, TX 78626-8050

Hays County Appraisal District

Mailing Address: 21001 IH 35 North, Kyle, Texas 78640

What you will need to file

Besides filling out the form and sending it in, you will also need to send a copy of your Texas driver's license and the address must match the homestead address.

Cost of filing for a homestead exemption

There is absolutely no cost associated with filing your homestead exemption. You will get mail from third party vendors offering to file your exemption for a fee. Do not pay them to file for you.

Resources

Texas Comptroller’s FAQ

Texas Property Tax Exemptions Tax Code

Other Exemptions you can potentially file for are here.

As a quick recap….

(1) If you bought a home in 2016, and

(2) it’s your primary residence as of January 1st, 2017, you can

(3) apply for a homestead exemption with your county appraisal district.

(4) The deadline to file is April 30th, 2017 and

(5) you will need to include a current Texas driver’s license or ID with the address matching the homestead address.

(6) The cost associated with filing for the exemption is ABSOLUTELY FREE.

At BIRDHOME, we strive to help our clients, friends + family build generational wealth through real estate investing. At the BIRDHOME blog, we're sharing our expertise in the Austin real estate market to help guide you to your new home.

let's connect

Contact us directly at home@birdhome.com

or call us anytime at 512.585.1571