November 2018 Market Report - Austin home prices are up 5.5% Year over Year

The Fall into Winter real estate market is still going strong in Austin. With sales up 5.5% in Austin and median homes prices still on the rise, look to 2019 housing market starting off really strong!

November 2018 Market Report - Austin home prices are up 5.5% Year over Year

We are nearing the end of the year and sales are still seeing positive trends with 2018 shaping up to be another record setting year.

Sales in City of Austin proper are still very strong with the median home price up 5.5% to $374,900 from last November . With 618 homes sold in November (down 5%) and only 1.9 month’s of housing inventory, Austin is still firmly in an Extreme Seller’s Market.

The rest of the Central Texas market is starting to see a slight slow down in sales with 2.7 month’s of housing inventory, up .2 month’s from last year. With slightly more housing inventory and homes taking a little longer to sell (average of 64 days on the market, up 3 days from last year) we may start to see home prices outside the city limits slow down. Right now, prices are still up (median home price is $301,391, up 2% YoY), homes sell are up (2,201 homes sold in November, up 1% YoY) and $839M in sales volume, up 6% Year-over-Year.

In summary,

SELLERS are in all parts of the market are still in a strong position to net top dollar on their home. Buyers have high expectations for what they are buying since it is starting to cost more per month for the same home with interest rates going up from 3.5% to 4.75-5% in just over a year.

BUYERS are starting to see slightly less competition for homes in the suburbs and outlying cities. The best homes are still selling fast and for top dollar, but there are starting to be more “Deals” out there.

INVESTORS are having to be patient while looking for the best deals and act fast when they come up. Income properties are harder to come by. Foreclosures are up slightly. Look to the smaller markets outside of Austin for the best investments.

See below for infographics and analysis of all parts of our Central Texas Real Estate Market.

And as always, please contact us if you or anyone you know needs help buying, selling or investing in real estate in 2019!

Here is the Press Release from the Austin Board of Realtors with the rest of the market update for November 2018.

AUSTIN, TX–As single-family home sales continue to rise, another record-breaking year is expected for the Austin-area housing market, according to the latest monthly report from the Austin Board of REALTORS®. The November 2018 Central Texas Housing Market Report released today suggests another strong showing for the region.

"Sales are up 3.3 percent year-to-date for 2018,” Steve Crorey, president of the Austin Board of REALTORS®, said. “Pending sales volume in December, the Central Texas housing market is on track to have one of the highest-grossing years on record."

Austin-Round Rock Metropolitan Statistical Area (MSA)

In the Austin-Round Rock Metropolitan Statistical Area (MSA), sales volume slightly increased 0.7 percent year over year from 2,185 sales in November 2017 to 2,201 sales last month. Sales dollar volume increased 5.6 percent year over year to $839,317,911, while the median home price increased 2.2 percent year over year to $301,391.

New listings for the five-county MSA increased 1.7 percent year over year to 2,380 listings in November. During the same period, active listings increased 11.5 percent to 6,907 listings and pending sales increased 2.5 percent to 2,217 pending sales. Monthly housing inventory increased by 0.2 months to 2.7 months of inventory.

"Families and young professionals continue to move to the suburbs where there are more opportunities for home ownership at a more reasonable price point than in the city of Austin," Crorey said. "While home sales growth isn't as rapid in the city, demand is still strong. Analysts predict Austin will be a market to watch in 2019."

City of Austin

In the city of Austin, home sales decreased 5.4 percent year over year from 653 sales in November 2017 to 618 sales last month. During the same period, sales dollar volume remained flat at $288,251,771. The median price of single-family homes rose 5 percent to $374,900. New listings decreased 3.9 percent to 697 listings; active listings decreased 2.4 percent to 1,487 listings; and pending sales decreased 4.6 percent to 638 pending sales. Monthly housing inventory decreased by 0.1 months to 1.9 months of inventory.

Travis County

In Travis County, November single-family home sales slightly decreased 0.5 percent year over year to 1,029 home sales, but sales dollar volume increased 5 percent to $474,252,517. The median price for single-family homes rose 5.4 percent to $355,000. During the same period, new listings decreased 0.9 percent to 1,189 listings; active listings increased 2.7 percent to 3,112 listings; and pending sales increased 0.8 percent to 1,058 pending sales. Monthly housing inventory decreased 0.1 months year over year to 2.4 months of inventory.

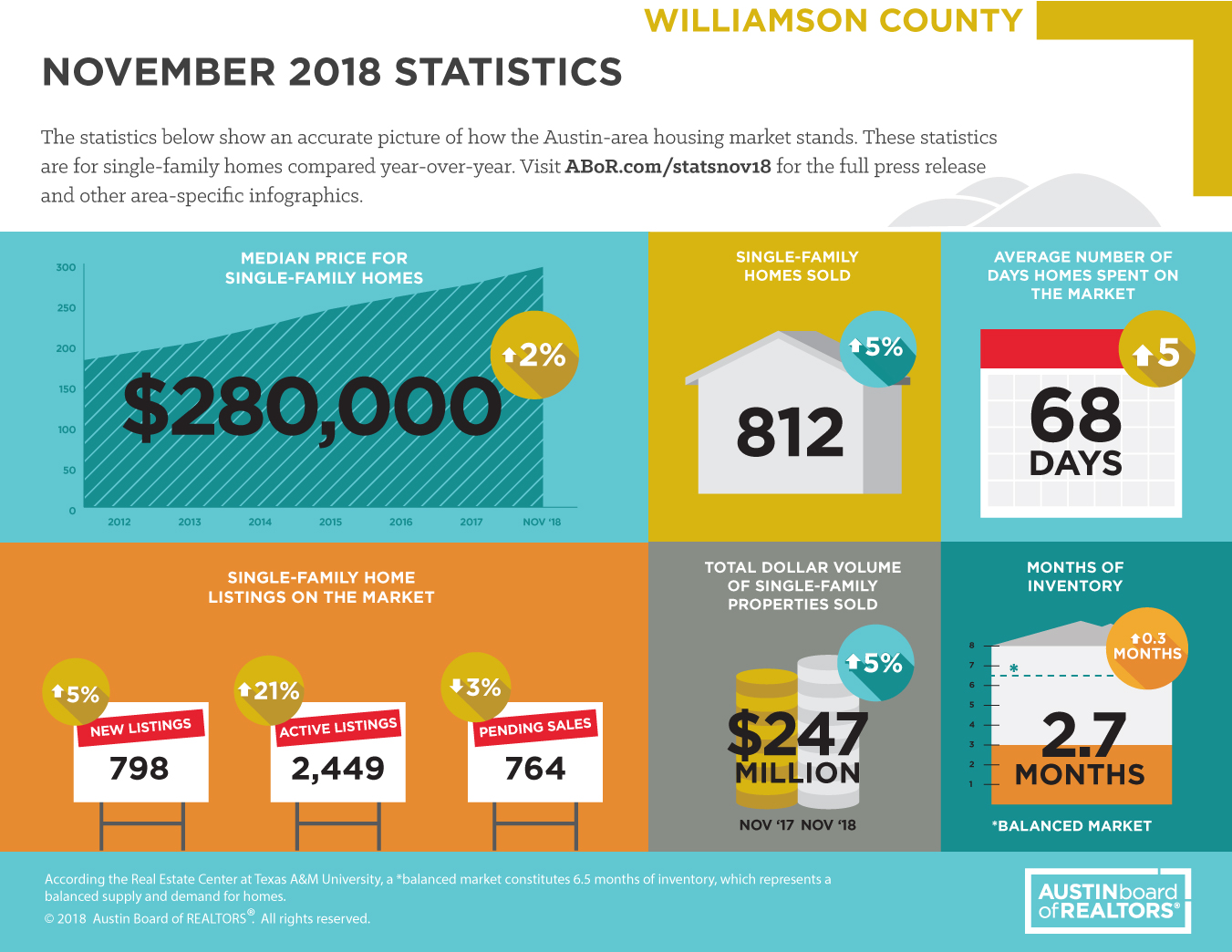

Williamson County

In November, Williamson County single-family home sales increased 4.5 percent to 812 home sales and sales dollar volume increased 4.9 percent to $246,902,818 since last November. During the same period, the median price for single-family homes increased 1.8 percent to $280,000. New listings increased 4.9 percent to 798 listings; active listings jumped 20.8 percent to 2,449 listings; and pending sales decreased 2.6 percent to 764 pending sales. Housing inventory increased 0.3 months year over year to 2.7 months of inventory.

Hays County

Hays County single-family home sales rose 1.9 percent to 269 sales in November, and sales dollar volume spiked 18.6 percent to $94,305,038. The median price for a single-family home increased 2.8 percent to $262,047. During the same period, new listings increased 7.3 percent to 281 listings; active listings experienced a double-digit increase of 15.9 percent to 950 listings; and pending sales increased 21.1 percent to 287 pending sales. Housing inventory increased 0.3 months to 3.2 months of inventory.

July 2018 Market Report - Single-family home sales experience double-digit growth

Summer is over and the market has started to enter it's cooling off period. School is starting, Football season is right around the corner and Austin is in need of a much needed break from the heat. The same goes for the Hotter than Hot real estate market that reached new highs for the month of July.

July 2018 Market Report - Single-family home sales experience double-digit growth

Summer is over and the market has started to enter it's cooling off period. School is starting, Football season is right around the corner and Austin is in need of a much needed break from the heat. The same goes for the Hotter than Hot real estate market that reached new highs for the month of July.

Here is a quick snapshot of what happened in July 2018:

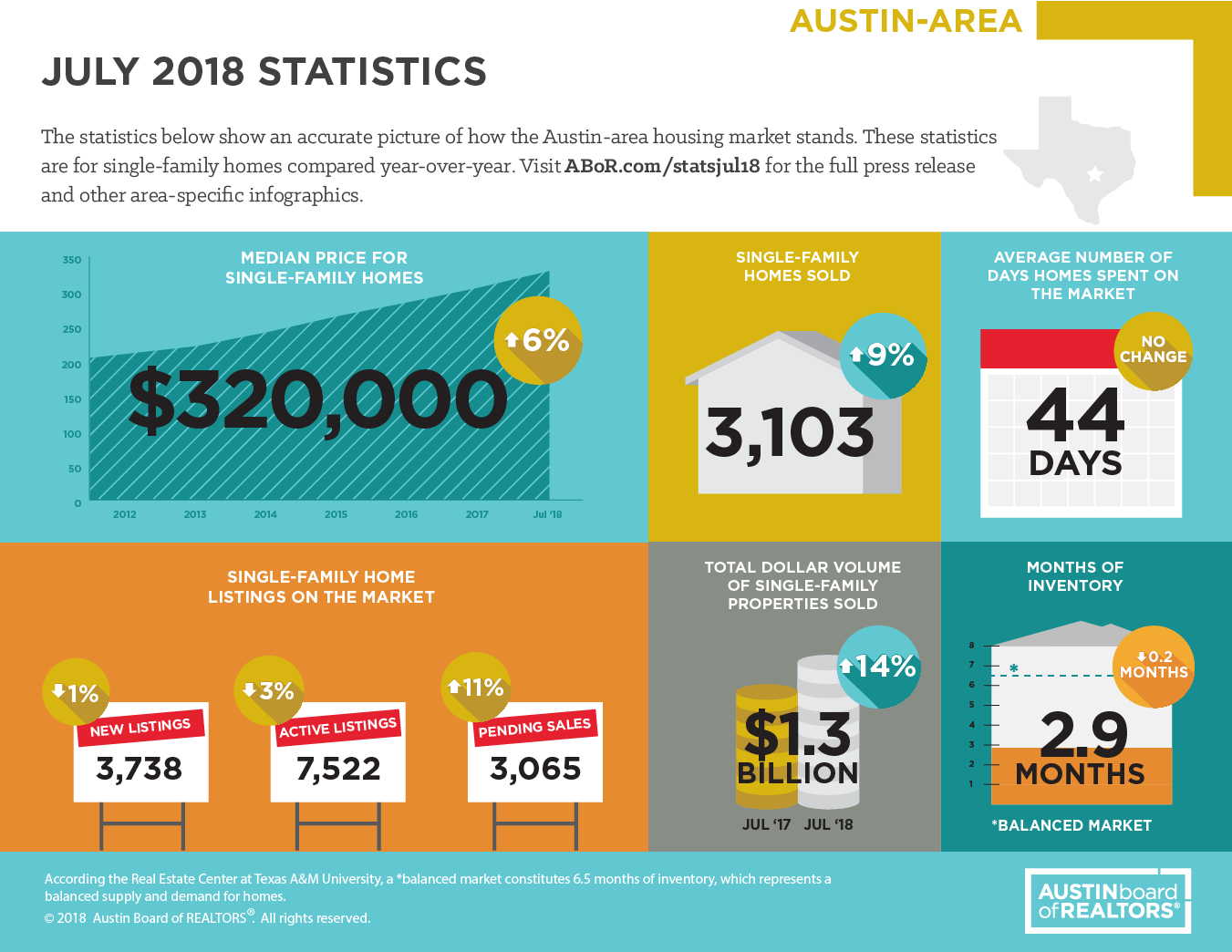

The Median home price for Central Austin (which includes the entire 5 county MSA) is $320,000, up 6% year over year. The volume of sales has also increased by 9%, up to 3,103 homes sold in July. The average days on market (44) and the total supply of homes (2.9 months of inventory) has stayed somewhat flat. However, with fewer homes coming on the market than last year and more homes selling, our market is continuing to tighten up with demand far exceeding supply.

Here is the Press Release from the Austin Board of Realtors with the rest of the market update for July 2018.

AUSTIN, TX– Strong homebuying activity throughout the summer led to double-digit home sales growth in July, according to the July 2018 Central Texas Housing Market Report released today by the Austin Board of REALTORS®. The five-county Metropolitan Statistical Area (MSA) experienced the highest volume of home sales since July 2011, and the highest median home price on record for any month.

“Strong pending sales activity in June contributed to a big uptick in home sales growth last month, and pending sales growth was strong again in July, too,” Steve Crorey, 2018 president of the Austin Board of REALTORS®, said. “This means we could see another uptick in home sales growth in August to end the summer selling season on a high note.”

In the city of Austin, single-family home sales experienced a double-digit increase of 13.5 percent year over year to 952 sales, while sales dollar volume increased 19.8 percent to $451,315,853 in July.

Austin-Round Rock Metropolitan Statistical Area (MSA)

In the Austin-Round Rock MSA, July single-family home sales increased 8.8 percent year over year to 3,103 sales, while sales dollar volume increased 13.7 percent to $1,254,255,680. The median home price increased six percent year over year to a record-breaking $320,000.

For the second month in a row, pending sales growth experienced strong gains across the MSA, increasing 8.3 percent year over year to 3,201 pending sales in June and 10.8 percent to 3,065 pending sales in July. However, the number of homes on the market fell during the same time frame. In July, active listings for the five-county MSA fell 2.7 percent to 7,522 listings and new listings decreased 1.2 percent to 3,738 listings.

“Housing construction is at an all-time high in Central Texas, but the pace of new housing stock entering the market can’t justify last month’s jump in sales growth on its own. These gains in home sales activity are being driven by pure demand,” Vaike O’Grady, Austin regional director for Metrostudy, said.

“Home sales are up across the board in the Austin area, but declines in housing inventory are almost just as steep. The city of Austin, in particular, lost almost half a month of inventory from July 2017 to July 2018. That's a lot of inventory to lose year over year,” Crorey said. “ABoR housing market data underscores not only the ongoing strong housing demand in our region, but the critical need for more housing stock at all price points in and around Austin.”

City of Austin

In the city of Austin, the July median price for a single-family home increased six percent year over year to $390,000. During the same time frame, new listings decreased seven percent to 1,066 listings; active listings decreased 13.8 percent to 1,675 listings; and pending sales rose 11.6 percent to 904 sales. Monthly housing inventory decreased 0.4 months to 2.1 months, well below the Real Estate Center at Texas A&M University’s benchmark of 6.0 months as a balanced housing market.

Travis County

In Travis County, July single-family home sales increased 15.7 percent year over year to 1,594 home sales, while sales dollar volume increased 17.5 percent to $769,540,765. The median price for single-family homes grew 4.5 percent to $375,000. During the same period, new listings remained relatively flat, with a 0.3 percent increase to 1,854 listings. Active listings decreased 7.8 percent to 3,543 listings, while pending sales jumped 12.3 percent to 1,503 sales. Monthly housing inventory decreased 0.3 months year over year to 2.8 months of inventory.

Williamson County

In Williamson County, July single-family home sales increased 5.7 percent year over year to 1,054 home sales, while sales dollar volume increased 7.7 percent to $326,159,581. During the same period, the median price for single-family homes increased 2.1 percent to $280,734. New listings decreased 6.5 percent to 1,204 listings; active listings decreased 2.1 percent to 2,497 listings; and pending sales rose 10.6 percent to 1,055 pending sales. Housing inventory decreased 0.2 months year over year to 2.8 months of inventory.

Hays County

In July 2018, Hays County single-family home sales rose 2.7 percent to 347 sales, while sales dollar volume slightly decreased, with a 0.6 percent decrease to $113,218,199. Median price decreased three percent year over year to $265,000. During the same time frame, new listings remained relatively flat, with a 0.2 percent increase to 478 listings; active listings increased 5.9 percent to 1,045 listings; and pending sales rose 6.1 percent to 366 sales. Housing inventory increased 0.1 months to 3.6 months of inventory.

Why You Should Buy In The Fall

It's no secret that Austin is considered by just about every metric to be a strong seller's market right now. In our most recent market report we shared that for August there were 2.8 months of inventory within Austin and balanced market is considered to be 6.5 months of inventory. This just further confirms what we all know - it's great to be selling your home but it can be difficult if you are looking to buy. However if you are looking to buy hope is not lost, we've got a few tips that can help you get the house that you want for the price that you're looking for.

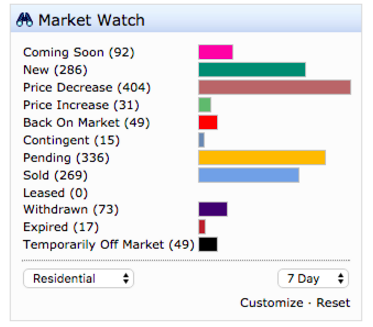

Currently there 2,519 homes on the Market in Austin, with another 4,874 are listed for sale in the surrounding areas. That is 5% more homes on the market than there were last year. And 958 of them are new construction homes. Within the last week, of those homes on the market, 404 have lowered their price, 49 homes fell out of contract and came back on the market and about 90 homes came off the market (either withdrawn or expired). This creates an environment that can benefit a smart buyer.

Here are four reasons it can be better for you to be buying in the fall:

Less Competition

Most homes sell in the spring and summer months. Everyone clamors when new houses come on the market during those months and all that competition can make it harder get an offer accepted, or even submit an offer in the first place. This past spring we saw it was quite common that buyers had to submit an offer immediately after the house when to market if they wanted a realistic shot of getting the house. With less buyers crowding the playing feel you've got opportunity to really search for the home of your dreams without worrying it will get snatched up immediately.

Serious Sellers

There are generally two types of sellers in the Fall, those who's homes went to market in the spring and summer and then sat until the fall or those who have to move out immediately, either because of jobs or family or something similar. This means that most sellers are seriously movtivated to sell. They aren't just testing the market or seeing what's out there, they need to sell and this is to the buyers advantage.

Negotiating can be a little easier

Now can be a good time to make lower offers to see if the seller will accept them. The average sale in Austin goes for 98% of the asking price. Based on a median sales price of $289,990, that’s an average of about $6,000 of the seller’s asking price.If you can negotiate the seller’s another 1-2% off of that, that translates into a savings of about another $3,000 to $6,000.

Sellers who have been on the market for awhile are more ready to deal

Of the 2600+ homes in Austin currently on the market, the average days they’ve been on the market is 88. This is double the normal average days on market of 40. It’s a great time to negotiate for that dream home or that smart investment property purchase.

We hope this post has shed some light on some of the advantages that buyer's have in the fall. Be sure let us know if we can help you out with your home search or if you want to talk about any of the topics we've talked about in this blog.

Where is Austin's Housing Market Going?

Recently an Austin-American Statesman article about the Austin housing market and its relationship to the national state of housing has been making the rounds on social media. And I think it deserves more than a simple share and/or typical Realtor, “Buy or sell with me” comment. So let's dig into what that article has to say and what it really means for you in the coming years.

Recently Gary Keller gave a speech at the Keller Williams Mega Agent Camp a few weeks ago focusing on the future of the housing market in the US. He predicted a coming downturn and warned agents to prepare for this. I was in the room for this and was beyond impressed with his in depth research and analysis of the topic. Not only is he looking at current economic trends both nationally and internationally, he is considering historical market cycles and shifts. And I agree with him on this - we are definitely trending towards a downturn.

I even wrote an in depth article about this very subject about a month ago titled, “Is it time to sell your Austin Investment Property?” The article is specific to real estate investors who tend to lead the market. My biggest concern is my investor clients getting over-leveraged in their real estate holdings, betting on the market, rather than truly investing in it. When the bubble burst in the housing market in 2007, because a lot of investors were over-leveraged with the rest of the overzealous homebuyers, the bust had a compound effect that could have easily been avoided with more conservative investing tactics.

What does the article say?

But if the national market slows down what does this mean for Austin? Let's take a look at what the article had to say. Shonda Novak, who’s work I’ve admired for years, has done an excellent job getting several top economists to give them predictions for our housing market. I want to tackle each one of their responses separately and dig into what they had to say and what my thoughts are on each of their answers.

Mark Sprague:

The most pointed comments were given by Mark Sprague of Independence Title. His acknowledgment of the housing market still being extremely hot, yet pricing increases have slowed down, is right on. However mark my words… it will continue to be a seller’s market for at least another 2-3 years. As Mark stated, the election will cause the market to slow for a short time. Once we settle into a new Presidency, the Austin market should settle back into it’s natural rhythm by Spring time with prices going up 3-5% per year, instead of the 8-12% of the past 3-4 years.

Mike Castleman:

Mike Castleman’s point about jobs is the most important aspect of his diagnosis of our real estate market. “Because unemployment is so low, when we create a new job, we have to import that employee, and that creates a housing demand unit immediately,” I like the phrase, “import employees” because it is so true. If you want to be gainly employed in Austin, there is opportunity everywhere. Case in point, we are going to be hiring at least 2-4 people in the next 3-6 months. If you know anyone that wants to break into the real estate world - send them our way.

Charles Heimsath:

The luxury market is always the first part of the market where we see a slow down. Most of the time this is because prices get so high, even the wealth start to shy away. Buyers aren’t able to “trade-up” into more expensive homes and their is just a much more limited buying pool at the top. This was the best part of Charle Heimath’s analysis. In looking at the luxury market in Austin ($1M or higher), there is currently 10+ months of housing inventory. For reference, the overall average of housing inventory is at 2.3 months. Historically, before the market began to improve in 2011, there was close to 64 months of luxury home inventory. Even though luxury home inventory is indicating that it might be more of a buyer’s market, there is still strong demand for homes that are priced right.

Eldon Rude:

Eldon Rude’s comments mainly focused on the strength of the job market. His observation that employment has increased by 28% in the last 6 years is eye-opening. As long as we continue to see job growth, the housing market should follow. And as stated above, the robust job market in Austin should shield us from most of a national downturn, should it occur.

What does this mean for us?

It looks like the top of the market is starting to soften some. The election and other National and International economies might begin to slow down our market. But as long as we continue to have steady job growth, we will see steady that population growth and housing will follow for at least another 2-3 years, if not longer. Any further questions? Let me know and I'd be happy to sit down with you to talk it over!

MORE RESOURCES

Gary Keller’s Slides from Mega Camp

Further reading on the housing market both locally and nationally: MarketWatch

Aquila Commercial’s Q2 Market Report - In depth study of the Austin’s economy and how it relates to real estate

At BIRDHOME, we strive to help our clients, friends + family build generational wealth through real estate investing. At the BIRDHOME blog, we're sharing our expertise in the Austin real estate market to help guide you to your new home.

let's connect

Contact us directly at home@birdhome.com

or call us anytime at 512.585.1571