2018 Austin Mid Year Market Update

Specifically, the real estate market has been experiencing some new highs and just a few indicators that the real estate market has been shifting. I decided to take a new approach to interpreting the data. I am including the Austin Board of Realtors entire Press Release here. I will be adding my thoughts and commentary in BOLD Italic…

Welcome to the second half of 2018!

The Austin real estate market has been experiencing some new highs and just a few indicators of a possible shift. We have decided to take a new approach to interpreting the data. We are including the Austin Board of Realtors entire Press Release here. I will be adding my thoughts and commentary in BOLD Italic.

---

Austin Board of REALTORS® releases June & Midyear 2018 Central Texas Housing Market Report

AUSTIN, TX– Single-family home sales in the Austin-Round Rock Metropolitan Statistical Area (MSA) experienced strong and steady growth in the first half of this year but declined in June 2018, according to the June & Midyear 2018 Central Texas Housing Market Report released today by the Austin Board of REALTORS®. In the first half of the year, area home prices continued to increase and housing inventory levels slowly declined amidst strong housing demand.

“Despite a decline in home sales volume across Central Texas in June, 2018 is on track to be another record-setting year for the region’s housing market,” Steve Crorey, 2018 president of the Austin Board of REALTORS®, said. “Consecutive years of record-breaking sales activity have set the bar incredibly high, and it’s important to remember that we’re comparing June 2018 figures to that strong activity. The Central Texas housing market remains strong and continues to move at a demanding pace.”

The slow down in sales is purely Supply-driven. Fewer people are putting their homes on the market, so there are fewer sales. Buyer demand remains at a record high.

Austin-Round Rock Metropolitan Statistical Area (MSA)

In the five-county MSA, single-family home sales increased 3.7 percent year-over-year to 15,364 home sales, while the median home price increased 4.3 percent year-over-year to $313,000. The volume of homes on the market declined year-to-date, although pending sales activity increased during the same time frame. From January to June 2018, active listings fell 0.8 percent to 5,951 listings; new listings decreased 0.6 percent to 21,795 listings; and pending sales rose 4.8 percent to 17,008 sales. Sales dollar volume in the Austin-Round Rock MSA was $6,025,035,605—an 8.2 percent increase from the first six months of 2017.

In June 2018, single-family home sales activity declined 2.7 percent year-over-year to 3,299 sales. During the same period, the median price for a single-family home rose 4.9 percent year-over-year to $326,250. Monthly housing inventory decreased 0.1 months year-over-year to 2.9 months, well below the Real Estate Center of Texas A&M University’s benchmark of 6.0 months as a balanced housing market. While home sales decreased across the MSA in June, this is not indicative of a declining housing market, suggested Jim Gaines, chief economist at the Real Estate Center at Texas A&M University.

“The Central Texas housing market is among the top three in the country. The region’s population growth, particularly along the I-35 corridor, is fueled by diversified economic opportunities that bring jobs, new businesses, and resources across multiple industries,” he said. “Strong population growth and home sales activity are expected to continue in the Central Texas region for the rest of the year and into 2019.”

Our overall market is still experiencing contracted inventory and increased demand. Buyers are either paying more for homes or buying new construction homes further outside of the city.

City of Austin

In the city of Austin, single-family home sales in the first half of the year edged upward 1.3 percent year-over-year to 4,757 sales and the median price for a single-family home increased 3 percent to $375,760. During the same period, active listings decreased 10.1 percent to 1,279 listings; new listings decreased 3.9 percent to 6,458 listings; and pending sales rose 2.7 percent to 5,248 sales.

City of Austin home sales have not experienced a year-over-year decrease in the month of June since 2013. Austin home sales decreased 4.5 percent to 988 home sales and median price dipped 0.4 percent to $388,000. Housing inventory also decreased 0.3 months to 2.1 months of inventory. However, homes spent six fewer days on the market in 2018 than the previous June, averaging 30 days on the market.

We are seeing a slight housing price correction in the City of Austin. Appraisers and banks are being more conservative to stave off a bubble. Median prices also could be going down slightly because there is even more activity below that price where there is more affordability as prices continue to rise.

Travis County

In Travis County, single-family home sales increased 3.8 percent year-over-year to 7,675 home sales in the first half of the year. During the same time frame, the median price for single-family homes grew 3.6 percent to $362,500. Active listings decreased 6.1 percent to 2,796 listings; new listings decreased 1.2 percent to 10,977 listings; and pending sales increased 6 percent to 8,587 sales.

In June 2018, single-family home sales decreased 2 percent to 1,651 home sales, while median price increased 1.2 percent to $374,500. Monthly housing inventory decreased 0.2 months to 2.8 months of inventory.

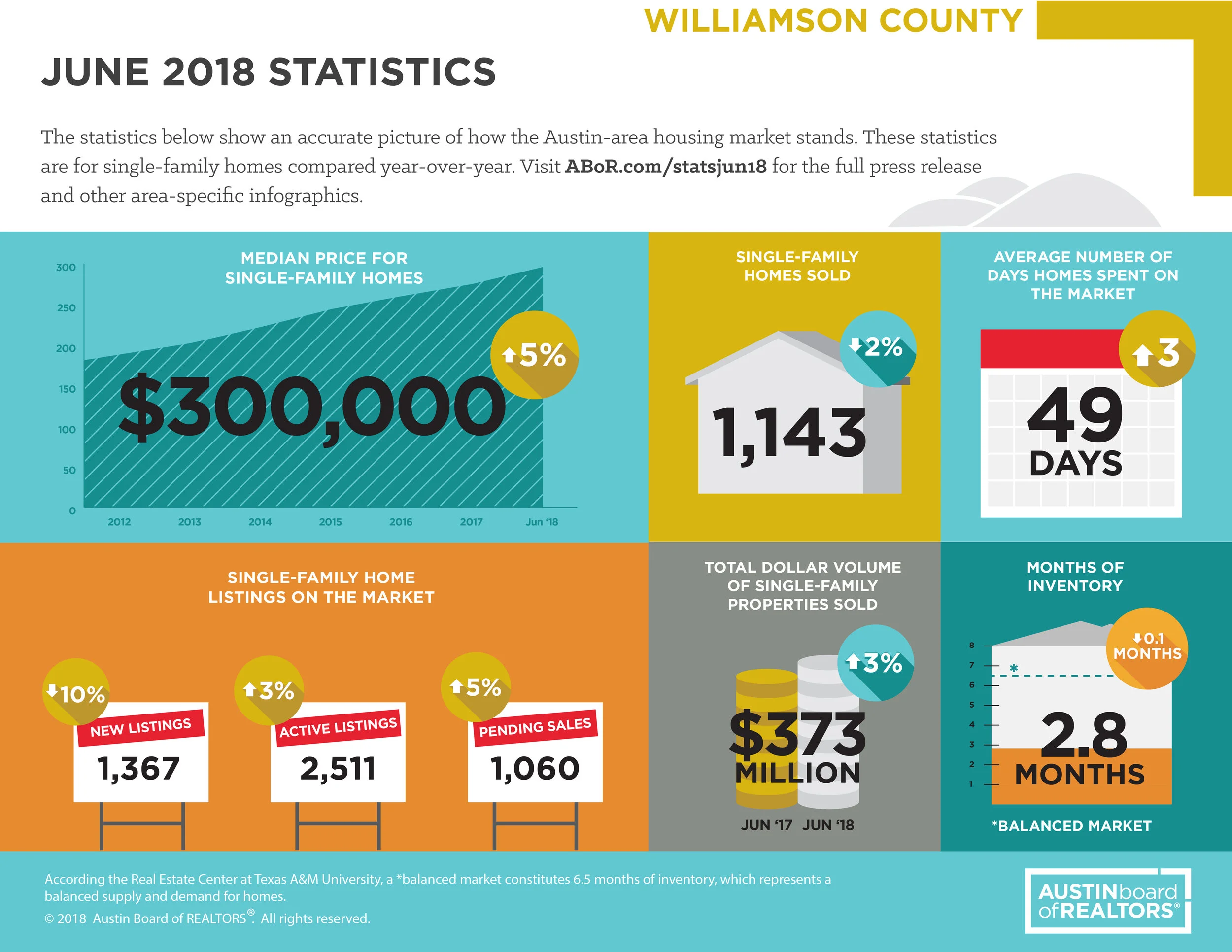

Williamson County

In Williamson County, single-family home sales in the first half of 2018 increased 5.2 percent year-over-year to 5,333 home sales. During the same period, the median price for single-family homes increased 3.7 percent to $286,900. Active listings increased 5.2 percent to 2,033 listings; new listings decreased 0.8 percent to 7,303 listings; and pending sales rose 4.7 percent to 5,832 sales.

In June 2018, single-family homes sales dipped 1.7 percent year-over-year to 1,143 sales, while the median price rose 4.7 percent to $300,000. During the same time frame, housing inventory declined 0.1 months to 2.8 months of inventory.

Hays County

In the first half of 2018, Hays County single-family home sales rose 2.6 percent year-over-year to 1,721 home sales, while median price increased 3.3 percent year-over-year to $264,900. New listings increased 2.2 percent to 2,536 listings and active listings increased 1.9 percent year-over-year to 799 listings. During the same time frame, pending sales rose 4.4 percent to 1,907 sales.

In June 2018, single-family home sales decreased 7.1 percent year-over-year to 369 sales, while median price increased 7.5 percent year-over-year to $284,900. During the same time frame, housing inventory increased 0.1 months to 3.4 months of inventory.

With new listings increasing in Hays and Williamson County, more people are willing to sell and move up or move closer in with the higher values of their homes. This trend will continue with affordability continuing to be an issue within Austin City Limits.

To find out what your home is worth in today's market or ask any related housing question, please don't hesitate to reach out to us at BIRDHOME---home@birdhome.com or call (512) 596-2035.

Where is Austin's Housing Market Going?

Recently an Austin-American Statesman article about the Austin housing market and its relationship to the national state of housing has been making the rounds on social media. And I think it deserves more than a simple share and/or typical Realtor, “Buy or sell with me” comment. So let's dig into what that article has to say and what it really means for you in the coming years.

Recently Gary Keller gave a speech at the Keller Williams Mega Agent Camp a few weeks ago focusing on the future of the housing market in the US. He predicted a coming downturn and warned agents to prepare for this. I was in the room for this and was beyond impressed with his in depth research and analysis of the topic. Not only is he looking at current economic trends both nationally and internationally, he is considering historical market cycles and shifts. And I agree with him on this - we are definitely trending towards a downturn.

I even wrote an in depth article about this very subject about a month ago titled, “Is it time to sell your Austin Investment Property?” The article is specific to real estate investors who tend to lead the market. My biggest concern is my investor clients getting over-leveraged in their real estate holdings, betting on the market, rather than truly investing in it. When the bubble burst in the housing market in 2007, because a lot of investors were over-leveraged with the rest of the overzealous homebuyers, the bust had a compound effect that could have easily been avoided with more conservative investing tactics.

What does the article say?

But if the national market slows down what does this mean for Austin? Let's take a look at what the article had to say. Shonda Novak, who’s work I’ve admired for years, has done an excellent job getting several top economists to give them predictions for our housing market. I want to tackle each one of their responses separately and dig into what they had to say and what my thoughts are on each of their answers.

Mark Sprague:

The most pointed comments were given by Mark Sprague of Independence Title. His acknowledgment of the housing market still being extremely hot, yet pricing increases have slowed down, is right on. However mark my words… it will continue to be a seller’s market for at least another 2-3 years. As Mark stated, the election will cause the market to slow for a short time. Once we settle into a new Presidency, the Austin market should settle back into it’s natural rhythm by Spring time with prices going up 3-5% per year, instead of the 8-12% of the past 3-4 years.

Mike Castleman:

Mike Castleman’s point about jobs is the most important aspect of his diagnosis of our real estate market. “Because unemployment is so low, when we create a new job, we have to import that employee, and that creates a housing demand unit immediately,” I like the phrase, “import employees” because it is so true. If you want to be gainly employed in Austin, there is opportunity everywhere. Case in point, we are going to be hiring at least 2-4 people in the next 3-6 months. If you know anyone that wants to break into the real estate world - send them our way.

Charles Heimsath:

The luxury market is always the first part of the market where we see a slow down. Most of the time this is because prices get so high, even the wealth start to shy away. Buyers aren’t able to “trade-up” into more expensive homes and their is just a much more limited buying pool at the top. This was the best part of Charle Heimath’s analysis. In looking at the luxury market in Austin ($1M or higher), there is currently 10+ months of housing inventory. For reference, the overall average of housing inventory is at 2.3 months. Historically, before the market began to improve in 2011, there was close to 64 months of luxury home inventory. Even though luxury home inventory is indicating that it might be more of a buyer’s market, there is still strong demand for homes that are priced right.

Eldon Rude:

Eldon Rude’s comments mainly focused on the strength of the job market. His observation that employment has increased by 28% in the last 6 years is eye-opening. As long as we continue to see job growth, the housing market should follow. And as stated above, the robust job market in Austin should shield us from most of a national downturn, should it occur.

What does this mean for us?

It looks like the top of the market is starting to soften some. The election and other National and International economies might begin to slow down our market. But as long as we continue to have steady job growth, we will see steady that population growth and housing will follow for at least another 2-3 years, if not longer. Any further questions? Let me know and I'd be happy to sit down with you to talk it over!

MORE RESOURCES

Gary Keller’s Slides from Mega Camp

Further reading on the housing market both locally and nationally: MarketWatch

Aquila Commercial’s Q2 Market Report - In depth study of the Austin’s economy and how it relates to real estate

At BIRDHOME, we strive to help our clients, friends + family build generational wealth through real estate investing. At the BIRDHOME blog, we're sharing our expertise in the Austin real estate market to help guide you to your new home.

let's connect

Contact us directly at home@birdhome.com

or call us anytime at 512.585.1571