Selling Over the Holiday Season

Historically, December is a better month to sell than the rest of the Fall or Winter, which is generally considered part of the "slower" season in real estate. There are a few reasons why this is the case and why it might be a good time to consider selling your house around the holidays. We also have a few tips and answer some often asked questions that you should need to know about if you are planning of selling during this time. And be sure to check out Patrick on Fox 7 below as he shares his tips for selling during the holidays.

Serious Buyers Only

This is one of the best parts about selling in the "slower" season - you're really only going to attract serious buyers. While this can seem like a bad thing it is far from it. This means that the buyers you get are extremely motivated to move on a house and they aren't as finicky and flaky as some spring buyers can be. Beyond this there are some specifics that make December a great time to sell if you are willing to play it right.

December Buyers are usually some combination of this:

- People that are relocating for jobs. There are lots of people that are relocating around this time of year and have a strong need to buy. They are usually under a time constraint and are looking to buy fast.

- People with a little extra cash to spend. This is the time of the holiday bonus; large cash bonuses get paid out when companies do well and this usually happens around the holidays. This means that there is a good chance that buyers have a little extra cash to use for that downpayment.

- People with time off. In December you have 2 weeks of downtime that you just don’t get any other time of the year. That means people who are looking to buy have a larger window of time to look and want to visit and see more houses.

Low Supply

December is historically one of the months with the lowest number of houses on the market. In December of 2015 there were just under 8,000 active listings on the market in Austin. For the months of May through September there was over 11,000 listings. That is 3000 less homes available to buyers in December than in the Spring. What this means is that there isn't a lot of competition from other sellers. Additionally as we detailed above the buyers are more motivated during this time of year, this can lead to low supply and high demand - which is always beneficial to the seller.

The Election

Now these reasons are general to most Decembers, however its important to remember that some effects are specific to certain years. For this December we just went through a very contentious election that had a lot of people on either side concerned. And traditionally when people are concerned about jobs or the future they are less likely to spend money, especially when it comes to something like a house. Now that the election is over we can expect a bit of a bounce back and some people who were thinking about buying in November but didn't, start their search up again.

Best practices for marketing/selling:

Should I/should I not put up holiday decorations?

Yes, but keep it tasteful, don’t go overboard. It can create an emotional connection for the buyer as well. Still want to declutter/depersonalize.

What do I do if someone wants to see my house on Christmas?

Yes. Only a very motivated buyer wants to see homes on a National holiday.

Pictures of the home during winter should be done sooner than later before the leaves change and before decorations go up.

Love It Or List It? A BIRDHOME Recap!

SHOULD I LOVE IT OR LIST IT?

We had the joy of participating in an amazing event last night with the incredible Amity Worrel & Co. that we just had to share with you! Over the past few month they have been putting on their Design 101 events to help share professional advice on interior design, architecture, and real estate amongst other things. We were ask to contribute to their Love It or List It event last night and it went so well that we decided we need to share some of the knowledge and advice from the event with you! So read our recap below and be sure to check out the three amazing ladies that we had the pleasure of speaking with last night: Amity Worrel, Dianne Kett, and Maureen Hodges. They are inspirations to us and we can't recommend them enough!

1. Make a list of what you love and what you don't love!

Even if you think you already know you want to renovate your house, its always good to go through and make a list of everything you love and don't love just to make sure you don't miss anything. And be sure to include things beyond just what is in the house itself, consider the neighborhood, neighbors, commute, and location as well! This will help you narrow down your list to the things you can change versus the things you can't and you can decide if you can just renovate or if you need to sell and something different.

2. Talk to an interior designer and architect

Once you have your list of what you love and don't love you can talk to an interior designer and/or an architect to get their opinion on budget and feasibility. A good general rule is that if you are just changing the setup of a room its okay just to reach out to an interior designer, but once you start talking about moving walls, changes plumbing or electrical, or adding on the house you'll need the knowledge and expertise of an architect as well. And any good interior designer will help you find one that you can trust! So make sure to reach out to them early and often - they are always will to help and get you moving in the right direction.

3. Decide - Love it or list it!

Now that you've talked to an interior designer and an architect its time to make that decision. Are you going to love it or are you going to list it. Maybe the architect comes to you and tells you that you can't add a second story or there is a heritage oak preventing you from extending that porch. Or maybe the budget and time just doesn't work for you. Or perhaps everything lines up perfectly and you're ready to move forward with making your house into a dream home. Either way - you'll be confident that you've got all the information to make the right decision for you!

4. Run the numbers

Either way though, once you've decided on what you're going to do make sure to reach out to a trusted real estate professional. Because a good agent will help you run the numbers. As we tell people all the time, buying or selling your house is a business transaction so its important to treat it like one. We can provide a valuation of your house currently and then what it would be after you renovate. If you are going to sell, we can help you through the process to make sure you can get top market value for your house. So don't hesitate to reach out to us, we understand that while this can be a very emotional moment it is also a very important financial one as well.

5. Think Like a Buyer

So once you've decided to sell and interviewed and hired your real estate agent its important that the goal of selling your house becomes the priority. And the best way to do this is to take it from being your home to becoming a house that someone else can turn into their home. We always recommend to our clients to run through our Seller's Checklist and start to think like a buyer. The easiest way to do this is to have a stager come in and make your house appeal to potential buyers, they can remove the emotion from the process of selling your house and make it so much easier for a buyer to imagine and dream of living there. This is such an important part of selling a house that we started our own staging company!

We hope this helped you as you consider remodeling or selling your house and if you have any questions please don't hesitate to reach out to us or the wonderful women that spoke (we'd be happy to connect you as well). And if you're interested in attending the next Design 101 class be sure to sign up to be on Amity's mailing list!

Why You Should Buy In The Fall

It's no secret that Austin is considered by just about every metric to be a strong seller's market right now. In our most recent market report we shared that for August there were 2.8 months of inventory within Austin and balanced market is considered to be 6.5 months of inventory. This just further confirms what we all know - it's great to be selling your home but it can be difficult if you are looking to buy. However if you are looking to buy hope is not lost, we've got a few tips that can help you get the house that you want for the price that you're looking for.

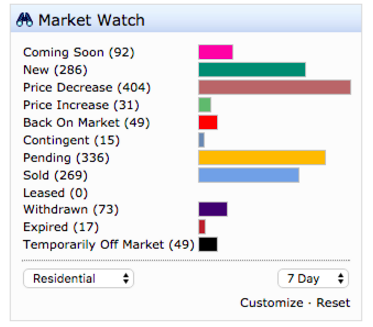

Currently there 2,519 homes on the Market in Austin, with another 4,874 are listed for sale in the surrounding areas. That is 5% more homes on the market than there were last year. And 958 of them are new construction homes. Within the last week, of those homes on the market, 404 have lowered their price, 49 homes fell out of contract and came back on the market and about 90 homes came off the market (either withdrawn or expired). This creates an environment that can benefit a smart buyer.

Here are four reasons it can be better for you to be buying in the fall:

Less Competition

Most homes sell in the spring and summer months. Everyone clamors when new houses come on the market during those months and all that competition can make it harder get an offer accepted, or even submit an offer in the first place. This past spring we saw it was quite common that buyers had to submit an offer immediately after the house when to market if they wanted a realistic shot of getting the house. With less buyers crowding the playing feel you've got opportunity to really search for the home of your dreams without worrying it will get snatched up immediately.

Serious Sellers

There are generally two types of sellers in the Fall, those who's homes went to market in the spring and summer and then sat until the fall or those who have to move out immediately, either because of jobs or family or something similar. This means that most sellers are seriously movtivated to sell. They aren't just testing the market or seeing what's out there, they need to sell and this is to the buyers advantage.

Negotiating can be a little easier

Now can be a good time to make lower offers to see if the seller will accept them. The average sale in Austin goes for 98% of the asking price. Based on a median sales price of $289,990, that’s an average of about $6,000 of the seller’s asking price.If you can negotiate the seller’s another 1-2% off of that, that translates into a savings of about another $3,000 to $6,000.

Sellers who have been on the market for awhile are more ready to deal

Of the 2600+ homes in Austin currently on the market, the average days they’ve been on the market is 88. This is double the normal average days on market of 40. It’s a great time to negotiate for that dream home or that smart investment property purchase.

We hope this post has shed some light on some of the advantages that buyer's have in the fall. Be sure let us know if we can help you out with your home search or if you want to talk about any of the topics we've talked about in this blog.

Where is Austin's Housing Market Going?

Recently an Austin-American Statesman article about the Austin housing market and its relationship to the national state of housing has been making the rounds on social media. And I think it deserves more than a simple share and/or typical Realtor, “Buy or sell with me” comment. So let's dig into what that article has to say and what it really means for you in the coming years.

Recently Gary Keller gave a speech at the Keller Williams Mega Agent Camp a few weeks ago focusing on the future of the housing market in the US. He predicted a coming downturn and warned agents to prepare for this. I was in the room for this and was beyond impressed with his in depth research and analysis of the topic. Not only is he looking at current economic trends both nationally and internationally, he is considering historical market cycles and shifts. And I agree with him on this - we are definitely trending towards a downturn.

I even wrote an in depth article about this very subject about a month ago titled, “Is it time to sell your Austin Investment Property?” The article is specific to real estate investors who tend to lead the market. My biggest concern is my investor clients getting over-leveraged in their real estate holdings, betting on the market, rather than truly investing in it. When the bubble burst in the housing market in 2007, because a lot of investors were over-leveraged with the rest of the overzealous homebuyers, the bust had a compound effect that could have easily been avoided with more conservative investing tactics.

What does the article say?

But if the national market slows down what does this mean for Austin? Let's take a look at what the article had to say. Shonda Novak, who’s work I’ve admired for years, has done an excellent job getting several top economists to give them predictions for our housing market. I want to tackle each one of their responses separately and dig into what they had to say and what my thoughts are on each of their answers.

Mark Sprague:

The most pointed comments were given by Mark Sprague of Independence Title. His acknowledgment of the housing market still being extremely hot, yet pricing increases have slowed down, is right on. However mark my words… it will continue to be a seller’s market for at least another 2-3 years. As Mark stated, the election will cause the market to slow for a short time. Once we settle into a new Presidency, the Austin market should settle back into it’s natural rhythm by Spring time with prices going up 3-5% per year, instead of the 8-12% of the past 3-4 years.

Mike Castleman:

Mike Castleman’s point about jobs is the most important aspect of his diagnosis of our real estate market. “Because unemployment is so low, when we create a new job, we have to import that employee, and that creates a housing demand unit immediately,” I like the phrase, “import employees” because it is so true. If you want to be gainly employed in Austin, there is opportunity everywhere. Case in point, we are going to be hiring at least 2-4 people in the next 3-6 months. If you know anyone that wants to break into the real estate world - send them our way.

Charles Heimsath:

The luxury market is always the first part of the market where we see a slow down. Most of the time this is because prices get so high, even the wealth start to shy away. Buyers aren’t able to “trade-up” into more expensive homes and their is just a much more limited buying pool at the top. This was the best part of Charle Heimath’s analysis. In looking at the luxury market in Austin ($1M or higher), there is currently 10+ months of housing inventory. For reference, the overall average of housing inventory is at 2.3 months. Historically, before the market began to improve in 2011, there was close to 64 months of luxury home inventory. Even though luxury home inventory is indicating that it might be more of a buyer’s market, there is still strong demand for homes that are priced right.

Eldon Rude:

Eldon Rude’s comments mainly focused on the strength of the job market. His observation that employment has increased by 28% in the last 6 years is eye-opening. As long as we continue to see job growth, the housing market should follow. And as stated above, the robust job market in Austin should shield us from most of a national downturn, should it occur.

What does this mean for us?

It looks like the top of the market is starting to soften some. The election and other National and International economies might begin to slow down our market. But as long as we continue to have steady job growth, we will see steady that population growth and housing will follow for at least another 2-3 years, if not longer. Any further questions? Let me know and I'd be happy to sit down with you to talk it over!

MORE RESOURCES

Gary Keller’s Slides from Mega Camp

Further reading on the housing market both locally and nationally: MarketWatch

Aquila Commercial’s Q2 Market Report - In depth study of the Austin’s economy and how it relates to real estate

Using Real Estate To Build That College Fund

SAVING FOR COLLEGE WITH REAL ESTATE

Two months ago, my wife and I welcomed twin boys into the world. In the next few months, we’ll have their entire college education effectively paid for using proportionally very little of our own money. How? Through long term real estate investing.

Our goal is a lofty one: be able to pay for 100% of our children’s total college expenses. This amounts to roughly $215,000 per child for four years at a public, in-state school by 2037, when the twins will begin their final year of college. So, we’re anticipating needing roughly $430,000. That’s in addition to meeting our own retirement, investing, giving, and lifestyle goals. Daunting!

However, we have a plan—and a rather simple one at that:

Buy a single family home and rent it out.

Let our tenants pay down the mortgage over the next 18 years.

Sell or refinance the property.

Use the proceeds to pay for our twins’ college expenses (or whatever else).

But there’s much more to it.

First, we have to define the right property. How much house should we buy? The initial constraint is that we need to net at least $430,000 from the sale or refinance of the property by the time college rolls around. We know we’re unlikely to hit this number exactly, and coming in too low would be much worse than ending up better than we planned. So, we’re choosing to err by overshooting our target.

Suppose that the property we buy will appreciate on average 5% each year for the next 18 years—a figure I believe to be slightly on the conservative side for central Texas, the Austin area especially. With 20% down and 4.625% fixed for 30 years—typical for non-owner occupied mortgages from retail lenders—we’re looking for a home worth around $240,000.

With $468,656 in projected equity after 18 years using conservative mortgage terms, we will have room to choose between selling the property and refinancing when 18 years is up. Either way, we should come out at or above the $430,000 target. Note, also, that the numbers above do not take into account reinvesting future rental cash flow into improving the property making additional mortgage payments. Once we take that into account, things look even better.

Beyond the numbers, we want at least a 3/2 home in a good school district and strongly prefer a single-story with at least three-sides masonry. We’re also not particularly concerned with the investment generating meaningful cash flow in the near term. In fact, we’d be happy if we can come close to breaking even over the next few years. We don’t expect rental rates to fall on single family in the Austin area over the next 18 years. In fact, we expect meaningful cash flow over the longer term as rental rates continue to rise. This will help us accelerate mortgage pay down and build equity faster.

Second, there’s the matter of actually finding the property. Our time horizon is long on this particular investment. So, we’re not against purchasing a rental-ready home straight off of the MLS. However, who’s not up for a deal? In a future blog post, I will detail some strategies I (and other investors) use to source deals in this hot central Texas seller’s market. However, in the Austin area market, for the type of property we’re looking for (described above), we’re most likely going to have to buy it retail on the MLS or from builder inventory.

Third, we need to determine the best way to buy the property. In one way or another, we’ll need to get a mortgage. Mortgage loans can come from many sources: private individuals, banks, mortgage brokers, mortgage bankers, credit unions, etc. It makes sense to shop around heavily. However, for a 30-year non-owner occupied fixed rate mortgage from a retail lender, we’re looking at around 4.625%. Mortgage insurance doesn’t cover investment properties. So, we’ll need to put at least 20% down, which comes out $48,000.

I realize that $48,000 is a significant amount to most of us. Indeed, the down payment will most likely be the largest hurdle for most of you reading this. In a future post, I’ll outline sources of long term investment property financing that can require less than the usual 20-25% down for well-qualified borrowers. It’s also possible to tap equity in your primary residence via a HELOC to make a down payment. However, realize that, if you’re going to be saving for your child’s college anyway, you can put off the strategy I’m describing here in order to raise the funds needed for a down payment. Just be sure the money you’re putting aside is invested in a vehicle that will keep pace with inflation and provide some growth, such as a short-term bond mutual fund.

The upside is that, once we commit that down payment, we’re effectively done paying for our kids’ college. For the next 18 years, we’ll have other people (our tenants) paying toward our kids’ future education while the property appreciates in value.

Fourth, we’ll have to get the property leased and managed. For those with less experience or time, but especially if it’s the first time, it almost always pays to work with a REALTOR®. He or she will help prepare, price, and market the property, ensure compliance with the relevant local, state, and federal regulations, provide leasing and other paperwork, screen potential tenants, and negotiate on your behalf. For these services, a REALTOR® typically requests compensation equal to one month’s rent. Fortunately, as an experienced REALTOR® and investor, I’m comfortable with all that goes into getting a property leased to a great tenant for top market rent in central Texas.

What about management? It is perfectly possible to manage one or a few single-family rental properties while maintaining a full-time job, as long as you have the temperament for it and the properties are within your immediate area. In fact, unless a property is a significant distance away, I don’t see any reason to have a single-family investment property professionally managed, unless you really are just too busy, uncomfortable being a landlord, or simply have too many properties to manage alone. Though nobody enjoys getting a call about a leaking water heater or a broken A/C in the middle of dinner, my wife and I enjoy even less someone else taking a cut of our rental income.

Finally, I’d like briefly to mention one unique benefit to this method of saving and paying for a child’s education on which it’s difficult to place a dollar value. As soon as my twins are old enough, which is sooner than you’d think, they will help me run every aspect of the property. I want them to really feel like it is their house, their tenant, their investment, and ultimately, their responsibility. They will need to learn to make and follow through with plans, interact with others, and work together to solve problems. This will provide me years of opportunities to teach financial and personal lessons and bond with my sons.

Though there are plenty of great ways to save for a child’s college (e.g., a 529 Savings Plan), my wife and I believe the real estate based strategy outlined above makes good financial sense. However, we are aware of the risks involved when compared to other options. I could give a list of pros and cons, but my goal here has been to describe what my wife and I plan to do, not argue that everyone should follow in our footsteps. However, I do think it’s something anyone facing the uphill battle to save for a child’s college expenses should consider seriously.

If you’d like to discuss real estate as a way to save for college (or even retirement), reach out to me below or give me a call at (512) 991-4801x3.

RELEVANT RESOURCES:

At BIRDHOME, we strive to help our clients, friends + family build generational wealth through real estate investing. At the BIRDHOME blog, we're sharing our expertise in the Austin real estate market to help guide you to your new home.

let's connect

Contact us directly at home@birdhome.com

or call us anytime at 512.585.1571